Loading

Get Irs Extends Economic Impact Payment Deadline To Nov. 21 To ...

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Extends Economic Impact Payment Deadline To Nov. 21 To ... online

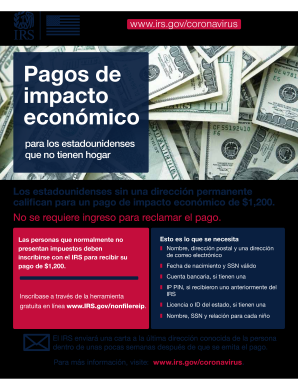

This guide provides a clear and supportive approach to filling out the IRS Extends Economic Impact Payment Deadline form online. Recognizing the importance of this payment for eligible individuals, we aim to offer user-friendly instructions to assist you throughout the process.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to access the required document and open it in the editor.

- Provide your full name and postal address in the designated fields. Make sure to include a valid email address for any correspondence from the IRS.

- Enter your date of birth and valid social security number (SSN) in the respective sections.

- If applicable, include your bank account information to facilitate direct deposit of the payment.

- If you have previously received an IP PIN from the IRS, enter it as requested.

- If you possess a state-issued license or identification, provide that information in the relevant field.

- List the name, SSN, and relationship for each qualifying child, if any, in the appropriate section.

- Review all provided information for accuracy before submission.

- Save your changes, and once ready, you can download, print, or share the completed form as needed.

Begin your application process by completing the required documents online now.

To request a payment extension from the IRS, submit Form 4868 before your payment due date. This form allows you to request an automatic extension for filing your taxes. Keep in mind that while this extends your filing date, it does not extend your payment deadline unless specified, such as with the IRS extends economic impact payment deadline to Nov. 21, giving you crucial extra time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.