Loading

Get Irs Publication 5420-a (sp) 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Publication 5420-A (SP) online

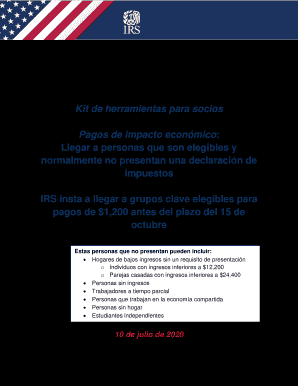

Filling out the IRS Publication 5420-A (SP) online is a straightforward process designed to assist individuals who typically do not file tax returns. This guide provides a comprehensive overview of each section of the form to ensure you can complete it accurately and efficiently.

Follow the steps to complete the IRS Publication 5420-A (SP) online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Provide your name and Social Security number in the fields specified. Ensure that your name matches what is on your Social Security card.

- Enter your date of birth and mailing address. This is important for confirming your identity and ensuring you receive any correspondence related to your payment.

- If applicable, list the names and Social Security numbers of any qualifying children. You must also provide their relationship to you.

- Include your bank account information, if you have one, to allow for faster processing of your payment. If you choose not to provide this, you will receive your payment by mail.

- Review all the information you have entered to ensure accuracy. Incorrect information may delay processing or result in denial of your payment.

- Once you are confident that all information is accurate, submit your completed form. Keep a copy for your records, as well as any confirmation messages received.

- You can save changes, download, print, or share the form as needed.

Complete your IRS Publication 5420-A (SP) online today to ensure you receive your economic impact payment promptly.

Filling out a tax exemption requires you to gather relevant documentation and understand the specific exemption criteria. You must provide the necessary information clearly on the form. For detailed instructions and to ensure accuracy, refer to IRS Publication 5420-A (SP), which serves as a valuable resource.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.