Loading

Get Irs 8050 2016-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8050 online

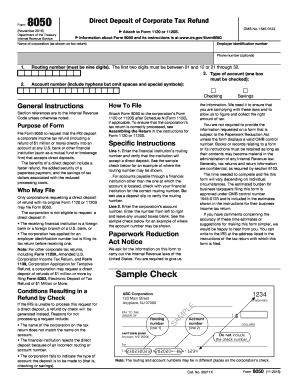

The IRS 8050 is a crucial form for corporations wishing to receive their tax refunds via direct deposit. This guide provides clear, step-by-step instructions on how to fill out this form online, ensuring a smooth and efficient process.

Follow the steps to complete the IRS 8050 online

- Press the ‘Get Form’ button to access the IRS 8050, which will open in your editor.

- In the first field, enter the corporate employer identification number, accurately reflecting the data from the tax return.

- Provide the name of the corporation as it is stated on the tax return.

- Optionally include a phone number for contact purposes.

- Input the routing number of the financial institution, ensuring it consists of nine digits and complies with routing number guidelines.

- Select the type of account by checking either the 'Checking' or 'Savings' box.

- Enter the account number, making sure to leave any unused boxes blank and following the formatting guidelines.

- Review all entered information for accuracy to avoid potential issues with direct deposit.

- Once all fields are completed, users can save the changes, download the form, print it, or share it as needed.

Get started with filling out your IRS 8050 online today!

To complete a withholding exemption form, start by indicating your personal information and filing status. Specify the reason for your exemption, ensuring you satisfy the criteria outlined by the IRS. Reference the IRS 8050 for clarity on any requirements to make the process smoother and more accurate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.