Loading

Get 2020 Irs Form Non Filers

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2020 IRS Form Non Filers online

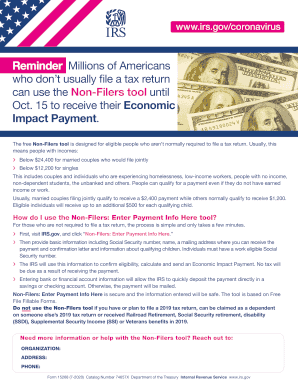

This guide provides a comprehensive overview of how to fill out the 2020 IRS Form Non Filers online. By following these steps, users can easily complete the form to receive their Economic Impact Payment if they are not typically required to file a tax return.

Follow the steps to correctly complete the form online.

- Click ‘Get Form’ button to obtain the online form and open it in the editing interface.

- Provide basic personal information in the designated fields. This includes your Social Security number, full name, and current mailing address to ensure the payment and confirmation can reach you.

- If applicable, enter details about any qualifying children in the appropriate section. This information will affect the total amount of your Economic Impact Payment.

- Review the eligibility criteria to make sure you qualify for the payment. Confirm that your income is below the required thresholds if you are filing jointly or as a single.

- Input your bank account or financial details if you wish to receive your payment via direct deposit. This will expedite processing; otherwise, the payment will be mailed.

- Double-check all entered information for accuracy. Ensure that everything is correct before finalizing the form.

- Once all sections are complete and verified, proceed to save your changes. You can then download, print, or share the completed form as needed.

Complete your 2020 IRS Form Non Filers online today to ensure you receive your Economic Impact Payment.

Related links form

Filing as a non-filer involves completing the 2020 IRS Form Non Filers accurately and submitting it to the IRS. Be sure to gather any necessary information to support your non-filer status. Using platforms like US Legal Forms can simplify the filing process, providing you with templates and guidance to ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.