Loading

Get Gst Invoice: Rules & Bill Formattally Solution

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GST Invoice: Rules & Bill FormatTally Solution online

This guide provides comprehensive and user-friendly instructions for filling out the GST Invoice: Rules & Bill FormatTally Solution online. Understanding how to accurately complete this form is essential for compliance and effective record-keeping.

Follow the steps to accurately complete your GST invoice online.

- Click ‘Get Form’ button to obtain the GST invoice form and open it in your chosen editor.

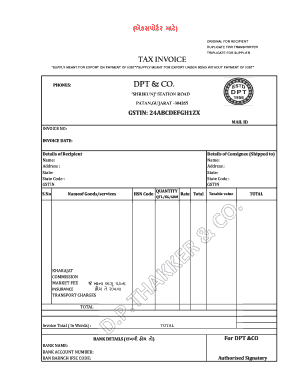

- Enter the type of invoice at the top of the form, selecting either 'Original for recipient,' 'Duplicate for transporter,' or 'Triplicate for supplier' based on the purpose of the invoice.

- Fill in the tax invoice section, indicating whether the supply is meant for export on payment of IGST or for export under bond without payment of IGST.

- Complete the 'DPT & CO.' section with the company's details such as name, phone numbers, and address.

- Provide the GSTIN, invoice number, and invoice date to ensure proper identification of the transaction.

- In the 'Details of Recipient' section, fill in the recipient's name, address, state, state code, and GSTIN.

- Next, in the 'Details of Consignee (Shipped to)' section, enter the relevant information about where the goods are shipped, including the name, address, state, state code, and GSTIN.

- List the goods or services provided by specifying the name, HSN code, quantity (in QTL/KG/GRM), rate, and taxable value for each item.

- Calculate and input any additional charges such as Kharajat, commission, market fee, insurance (if applicable), transport charges, and total.

- Finally, input the invoice total in both numerical form and in words, and complete the bank details section if necessary.

- Conclude by obtaining the authorized signatory's signature to validate the document before saving, downloading, printing, or sharing the completed invoice.

Start filling out your GST invoice online today to ensure compliance and efficient record-keeping.

The GST rule for invoices encompasses guidelines for what should be included, the timing of issuance, and record-keeping requirements. Accurate compliance ensures businesses maintain transparency and avoid penalties. The US Legal Forms platform can serve as a valuable resource for navigating these rules related to GST Invoice: Rules & Bill Format Tally Solution.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.