Loading

Get Form 708

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 708 online

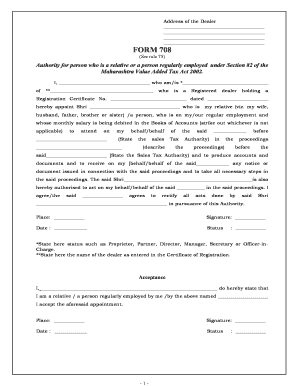

Filling out the Form 708 online can seem daunting, but with clear guidance, you can complete it with confidence. This form authorizes a representative to act on behalf of a registered dealer under the Maharashtra Value Added Tax Act 2002.

Follow the steps to complete Form 708 easily

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first field, enter your name where it asks for the person representing the dealer. Make sure to write your full name clearly.

- Specify your relationship to the dealer or your role as a person employed by the dealer in the designated section. Select from available options or describe your status, such as proprietor or partner.

- In the next section, provide the name of the registered dealer as shown in the Certificate of Registration.

- Fill in the dealer's registration certificate number in the provided field, along with the date it was issued.

- Appoint the individual who will represent you by entering their name and confirming their relationship or employment status as required.

- Indicate the date for which this authorization is valid and clarify the nature of the proceedings before the designated sales tax authority.

- Review and ensure all information entered is correct, then sign the form, enter the date, and indicate your status.

- Complete the acceptance section by having the appointed representative fill in their information, including name, relationship or employment status, and signature.

- Once all fields are completed, save the form, and consider downloading, printing, or sharing it as needed.

Start completing your documents online today!

Yes, you can file Form 709 as a separate form from your annual tax return. In fact, Form 709 is designated specifically for gift tax reporting, which allows you to keep your gift transactions distinct from your regular income tax filings. Taking this approach can simplify your tax records. Using US Legal Forms can help you prepare and submit Form 709 efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.