Loading

Get Crs Form 2017 - Ubl

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CRS Form 2017 - UBL online

Filling out the CRS Form 2017 - UBL online is a straightforward process that requires careful attention to detail. This guide aims to help you accurately complete each section of the form, ensuring compliance with tax regulations and facilitating smooth processing.

Follow the steps to successfully complete the CRS Form 2017 - UBL online.

- Press the ‘Get Form’ button to access the CRS Form 2017 - UBL and open it in your preferred editor.

- Provide your date of birth in the designated format (dd/mm/yyyy). Ensure accuracy as it is critical for identity verification.

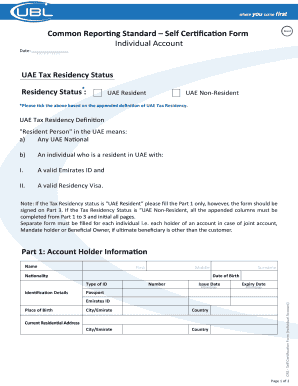

- Select your residency status by choosing either ‘UAE Resident’ or ‘UAE Non-Resident’. If you are a UAE Resident, proceed to fill out Part 1 only; if you are a UAE Non-Resident, complete all required sections.

- In the Name section, enter your first name, middle name (if applicable), and surname. Accuracy here is crucial.

- For Identification Details, select the type of ID you are providing—either Passport or Emirates ID. Fill in the corresponding number, issue date, and expiry date.

- Complete the Place of Birth section by providing the city/emirate and country where you were born.

- Navigate to Part 2: Country of Residence for Tax Purposes. List the countries where you are considered a tax resident, your Tax Identification Number (TIN) for each, and specify a reason if a TIN is unavailable.

- If you are a tax resident in more than three countries, make sure to attach a separate sheet with the additional information.

- Finally, go to Part 3: Declaration. Read the statement carefully, and confirm the information provided is accurate. Sign and date the form.

- Once all sections are complete, save your changes, and proceed to download, print, or share the document as necessary.

Complete your CRS Form 2017 - UBL online efficiently and ensure all necessary information is accurately filled.

A CRS self-certification is a declaration made by individuals to confirm their tax residency status as specified by the Common Reporting Standard. This process ensures that financial institutions can accurately report relevant account information to tax authorities. Utilizing the CRS Form 2017 - UBL simplifies this step, aiding in transparency and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.