Loading

Get Eic

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Eic online

This guide provides a comprehensive overview of filling out the Earned Income Credit (Eic) form online. Whether you are a first-time filer or need a refresher, this resource aims to support your experience.

Follow the steps to successfully complete your Eic form.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering your basic information. Ensure that your name and address are accurate as these details are crucial for the processing of your credit.

- Next, you will need to determine your filing status. Select the appropriate option based on your situation, such as single, head of household, or married filing jointly.

- Indicate the number of qualifying children you have. This section plays a significant role in calculating your credit amount. You will need to provide details such as the children's names and Social Security numbers.

- After that, input your income information in the specified fields. Make sure to accurately report your earned income from all sources, as this will directly affect the amount of your credit.

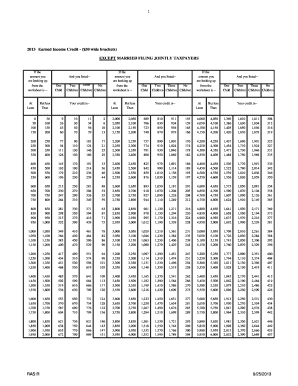

- Review the income thresholds for your filing status and the number of qualifying children. This will help you find the correct credit amount using the worksheet provided.

- Finally, once all fields are completed, save your changes. You can then download, print, or share your completed Eic form as needed.

Complete your Eic form online today and take advantage of your eligible tax credits.

After you file your tax return, the IRS will notify you if you received the EIC. You can check the status of your refund online through the IRS website. Additionally, if you used tax preparation software or services like those offered by US Legal Forms, you may receive updates on your EIC status as part of their service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.