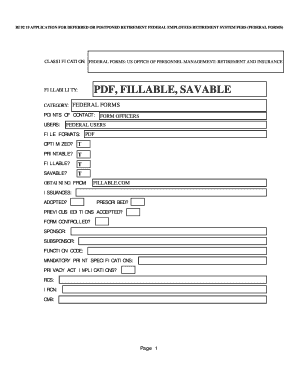

Get Ri 92 19

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri 92 19 online

Filling out the Ri 92 19 form online can streamline the application process for deferred or postponed retirement under the Federal Employees Retirement System. This guide will provide you with a comprehensive overview of each section of the form, equipping you with the knowledge needed to complete it efficiently.

Follow the steps to successfully complete the Ri 92 19 form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Begin by entering your personal information in the designated fields. Ensure to include your full name, address, contact number, and email address for clear communication.

- Next, provide your federal employment information. Fill in your employee identification number, the agency you worked for, and your position title.

- Proceed to the retirement options section. Indicate whether you are applying for deferred or postponed retirement by selecting the appropriate checkbox.

- In the next section, detail any service credit you hold. Provide relevant dates and types of service, ensuring accuracy to support your application.

- Review the declaration statement. Check the box to certify that all provided information is true and accurate. Your signature will be required in the final step.

- Once all fields are completed, save your changes. You can choose to download, print, or share the form as needed.

Complete your Ri 92 19 form online today for a smoother retirement application process.

A discontinued service retirement occurs when an employee separates from service unexpectedly and meets specific eligibility criteria. This type of retirement can be beneficial, especially when detailed in the context of RI 92 19 guidelines. If you are in this situation, understanding the nuances is vital for your benefits. US Legal Forms can provide the necessary resources to guide you through the procedures.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.