Get G2s Returns Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G2S Returns Form online

This guide provides step-by-step instructions on how to accurately fill out the G2S Returns Form online. Whether you are familiar with digital document management or new to the process, this comprehensive guide will support you in completing the form effectively.

Follow the steps to fill out the G2S Returns Form

- Click ‘Get Form’ button to access the G2S Returns Form and open it in your chosen digital document platform.

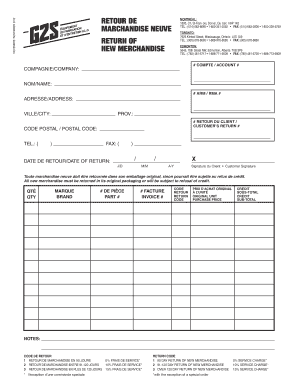

- In the top section labeled 'COMPTE / ACCOUNT,' enter your company name and contact information. Ensure that the information is accurate to facilitate the return process.

- Under the 'ARM / RMA' section, provide the appropriate address and city for the return. Be sure to double-check these details for correctness.

- Fill in the 'DATE DE RETOUR / DATE OF RETURN' fields, specifying the day, month, and year of the return. Accurate dates help track your return efficiently.

- In the 'RETURN OF NEW MERCHANDISE' section, list each item being returned. For each item, include the quantity ('QTÉ'), brand ('MARQUE'), part number ('# DE PIÈCE'), invoice number ('# FACTURE'), and the original purchase price ('PRIX DʼACHAT ORIGINAL À LʼUNITÉ').

- Select the applicable return code ('CODE DE RETOUR') based on the return duration, which determines any potential service charges. Review the return policy to select the correct code.

- Add any additional notes regarding the return in the 'NOTES' section, if necessary, to provide more context for your return.

- Review all filled information for accuracy and completeness. Once satisfied, you can save the changes you have made, and are also able to download, print, or share the completed form as needed.

Start filling out your G2S Returns Form online now for a smooth return process.

To properly fill out a tax withholding form, start by gathering your personal and employment information, including your Social Security number and address. Determine the correct filing status and any deductions or allowances you wish to claim to ensure accurate withholdings. Take your time to review each section thoroughly, and use the G2S Returns Form as a resource to clarify any uncertainties during this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.