Get Facta Alert Validation Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Facta Alert Validation Form online

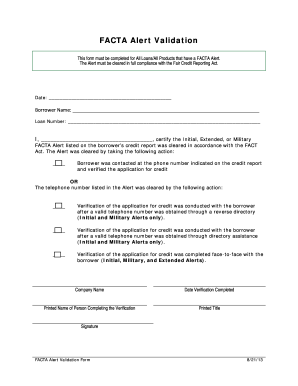

Filling out the Facta Alert Validation Form is an essential step to ensure compliance with the Fair Credit Reporting Act. This guide will provide you with clear instructions on how to complete the form online, making the process smooth and efficient.

Follow the steps to effectively complete the Facta Alert Validation Form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in the date at the top of the form in the designated space.

- Enter the borrower's name clearly in the provided field.

- Complete the loan number section with the accurate loan identifier.

- In the certification section, write your name in the space provided, affirming that the FACTA Alert has been cleared.

- Indicate how the alert was cleared by checking the appropriate box. You can choose from options such as verifying the borrower's application via a phone call or face-to-face interaction.

- Provide the name of your company under the Company Name section.

- Document the date when the verification was completed.

- Print your name, title, and provide your signature at the bottom of the form.

- Once all fields are completed, save your changes, download, print, or share the form as necessary.

Complete your Facta Alert Validation Form online today for a seamless experience.

FACTA requires financial institutions to provide consumers with access to their credit reports and to enable them to place fraud alerts on their files. This law emphasizes the importance of consumer rights regarding personal information. By completing a Facta Alert Validation Form, you play a crucial role in protecting yourself against identity theft. Essentially, FACTA promotes transparency and accountability in how credit information is handled.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.