Loading

Get Hdfc Fatca Form For Non Individual

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hdfc Fatca Form For Non Individual online

Filling out the Hdfc Fatca Form For Non Individual is a crucial step for compliance with tax regulations. This guide provides a clear and structured approach to ensure accurate completion of the form online, assisting users in navigating each section seamlessly.

Follow the steps to effectively complete the Hdfc Fatca Form For Non Individual.

- Click ‘Get Form’ button to access the Hdfc Fatca Form For Non Individual and open it for editing. This will allow you to begin the process of filling out necessary information.

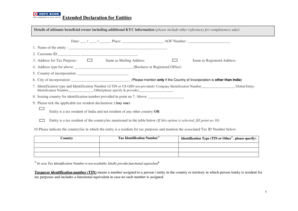

- Enter the name of the entity in the designated field. Make sure to spell it accurately to avoid any discrepancies.

- Provide the Customer ID, which is essential for identifying your entity in the system.

- Indicate the address for tax purposes. You can select from the options available: Same as Mailing Address or Same as Registered Address. Fill in the details based on your selection.

- Specify the type of address for the above selection as either Business or Registered Office.

- Fill in the country of incorporation of the entity along with the city of incorporation if it differs from India.

- Provide the identification type and identification number. This includes Company Identification Number, Global Entity Identification Number, and specify any other relevant identifiers.

- State the issuing country for the identification number provided earlier.

- Tick the applicable tax resident declaration to affirm whether the entity is a tax resident of India only or of other countries.

- If applicable, list countries of tax residence and their corresponding Tax Identification Numbers in the provided sections.

- Complete the declaration parts (Part A or Part B) according to your entity type, either as a Financial Institution or Non-Financial Entity.

- Ensure that all information provided about controlling persons is accurate, including their details and tax residency information.

- Review the certification section to confirm the accuracy and completeness of the information provided, including signing where required.

- Once all fields are filled out correctly, you can save the changes, download, print, or share the completed form as needed.

Start completing your Hdfc Fatca Form For Non Individual online today to remain compliant with tax regulations.

To register for FATCA online, access your HDFC Bank account through the online portal. Follow the designated steps in the FATCA registration section and ensure that you complete the requested forms, including the HDFC FATCA Form For Non Individual. This process guarantees that you remain in compliance with the bank's regulations pertaining to tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.