Get Bir Form 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 2000 online

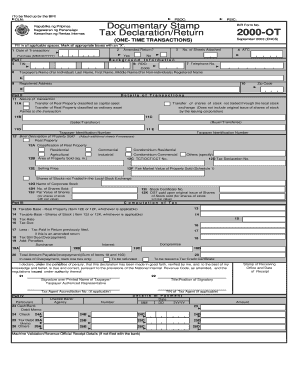

The Bir Form 2000 is essential for reporting one-time transactions, such as the sale of real property or shares of stock. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to efficiently fill out the Bir Form 2000 online.

- Press the ‘Get Form’ button to retrieve the form, allowing you to view and complete the necessary fields.

- Enter the Document Locator Number (DLN) in the designated field at the top of the form.

- If applicable, indicate whether this is an amended return by marking the appropriate box.

- Fill in the date of the transaction and the number of sheets attached to the form.

- Provide your Taxpayer Identification Number (TIN) and select the applicable Revenue District Office (RDO) code.

- Enter the taxpayer's name, including last name, first name, and middle name if an individual; or the registered name if an organization.

- Complete the registered address section, including the zip code.

- In Part II, indicate the nature of the transaction, selecting from options such as transfer of real property or transfer of shares of stock.

- Identify the parties involved in the transaction by providing their details as required.

- Fill out the brief description of the property sold and other details, including relevant identification numbers.

- In Part III, compute the tax by selecting the applicable taxable base and tax rate.

- List any tax previously paid, if this is an amended return, and calculate any remaining tax due or overpayment.

- Complete the declaration section, signing over your printed name and providing any required details, such as tax agent information if applicable.

- Finally, review all information for accuracy, then save changes, download, print, or share the completed form as necessary.

Complete your Bir Form 2000 online today to ensure compliance and timely reporting of your one-time transactions.

The return period in BIR Form 2000 primarily aligns with any changes to your personal data throughout the taxable year. It is essential to submit the form during the year it reflects, allowing the Bureau of Internal Revenue to update your records accurately. Understanding this return period can help you stay compliant with tax regulations. Utilize US Legal Forms for an easy filing process and helpful templates.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.