Get Net Tangible Benefit Fannie Mae

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Net Tangible Benefit Fannie Mae online

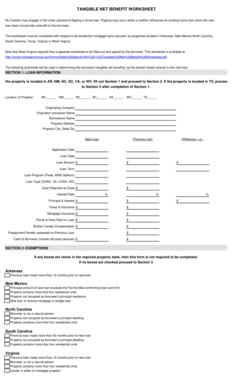

The Net Tangible Benefit Fannie Mae form is essential for documenting the advantages of refinancing a home loan. This guide provides step-by-step instructions on how to complete the form effectively online, ensuring users understand each section and field.

Follow the steps to successfully complete the form

- Press the ‘Get Form’ button to obtain the form and open it for editing. This will allow you to access the necessary fields to fill out.

- Begin with Section 1: Loan Information. Fill in the location of the property from the specified states, and provide details about the originating company, loan amounts, terms, and rates for both the new and previous loans.

- If applicable, complete Section 2: Exemptions. Review the boxes for your specific state. If any boxes are checked, this may indicate that the form does not need to be completed. If no exemptions apply, proceed to Section 3.

- In Section 3: Borrower Benefits, carefully check all boxes that apply based on the benefits the new loan offers. This can include conditions like lower monthly payments, beneficial loan term changes, or cash-out refinancing.

- Navigate to Section 4: Determination of Benefit. Based on the selections made in Section 3, determine if a tangible benefit exists for the borrower. Ensure to follow the specific conditions for your state regarding the number of checked benefits.

- If the property is located in South Carolina, fill out Section 5: Special and Low-Rate Mortgages to confirm if the loan passes the benefit test based on the previous loan type.

- Finally, review your completed form for accuracy. Ensure that all relevant sections are filled out, then save your changes. You may download, print, or share the finished form as needed.

Complete your Net Tangible Benefit Fannie Mae form online today to ensure you benefit from refinancing options.

An example of a tangible benefit would be the savings achieved from refinancing a mortgage at a lower interest rate. This saving translates directly into reduced monthly payments, allowing you to allocate those funds to other essential areas of your budget. Exploring these tangible benefits can significantly affect your financial decisions, especially when dealing with Fannie Mae.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.