Loading

Get Kentucky Schedule Rc Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kentucky Schedule Rc Form online

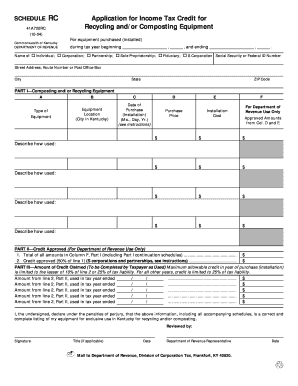

The Kentucky Schedule Rc Form is used to apply for an income tax credit for recycling and composting equipment. This guide provides clear, step-by-step instructions to help users navigate the form online.

Follow the steps to complete your Kentucky Schedule Rc Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter the type of equipment you purchased in Column A. Ensure the description clearly explains how the equipment is used for composting or recycling.

- For Column B, specify the city in Kentucky where the equipment is located. If it is not within a city, provide the name of the county.

- In Column C, fill in the date of purchase or installation. This should be formatted as month, day, and year.

- Column D requires you to input the purchase price of the equipment. Ensure this reflects the actual costs associated with the acquisition.

- Insert the installation cost in Column E. This should cover all expenses related to the setup of the equipment, including shipping.

- Column F is to be left blank as it will be completed by the Department of Revenue.

- Once all sections have been completed, review the information for accuracy. Then, proceed to save changes, download, print, or share the form as needed.

Complete your Kentucky Schedule Rc Form online today to take advantage of your tax credits!

Filling out the declaration of domicile in Kentucky requires you to declare your permanent residence. You should provide accurate information regarding your living situation and reference details from your Kentucky Schedule Rc Form if you own a business. Once completed, submit it to the appropriate local authority to ensure proper processing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.