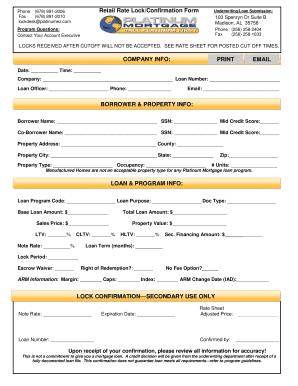

Get Retail Rate Lock/confirmation Form Company Info: Borrower ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Retail Rate Lock/Confirmation Form COMPANY INFO: BORROWER ... online

Filling out the Retail Rate Lock/Confirmation Form online is an essential step to secure the best loan rate for your mortgage. This guide will walk you through each section to ensure that your submission is accurate and complete.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the Retail Rate Lock/Confirmation Form and open it in your preferred document editor.

- In the COMPANY INFO section, enter the current date and time. Provide the name of the company, loan number, and contact details of the loan officer, including their phone number and email address.

- In the BORROWER & PROPERTY INFO section, fill in the borrower’s name and social security number, along with their mid credit score. If applicable, enter the co-borrower’s details similarly.

- In the LOAN & PROGRAM INFO section, provide the loan program code, loan purpose, document type, base loan amount, and total loan amount. Include the sales price and property value.

- Complete the ARM information if applicable, including margin, caps, index, and ARM change date.

- Once all sections are filled, review the form for accuracy and save your changes. You can choose to download, print, or share the completed form as needed.

Ensure to complete your Retail Rate Lock/Confirmation Form online for a smooth and efficient loan process.

The streamlined rate lock on Fannie Mae allows borrowers to quickly secure competitive interest rates without extensive documentation or credit checks. This process is particularly beneficial for those refinancing, as it may lead to a faster closing. The streamlined approach simplifies the borrowing experience, reduces stress, and can result in significant savings. The Retail Rate Lock/Confirmation Form can help facilitate this efficient process.

Fill Retail Rate Lock/Confirmation Form COMPANY INFO: BORROWER ...

Loan Officer Information. Account Executive Information. The following lock form is only to be used when DASH is not available for locking. Please contact your Account. The state of Washington requires the borrower(s) be provided the Rate Lock Agreement disclosure within three (3) business days from when the rate is locked. A statement of whether the disclosed interest rate is locked for a specific period. Early Rate-Lock (ERL) pdf allows borrowers to lock the full note rate months before closing, with limited preliminary requirements. Borrower understands that quoted rates reflect the currently available lending rate only. Get a Mortgage Rate Lock and Loan Preapproval. Contact WEOKIE today to make sure you enter the housing market as the strongest buyer you can possibly be.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.