Loading

Get Request For Verification Of Loan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request For Verification Of Loan online

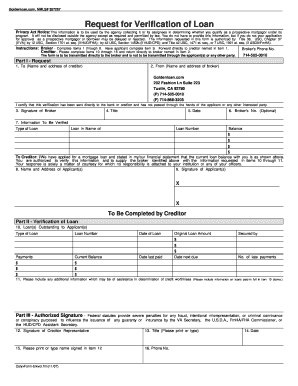

Filling out the Request For Verification Of Loan is an essential step in the mortgage application process. This guide will provide clear instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin with Part I - Request. In the first section, fill in the name and address of the creditor under 'To'.

- Next, enter your information as the broker in the 'From' section, including your name and address.

- Certify the submission by signing in the designated area for the broker’s signature.

- Indicate your title in the space provided, alongside the date of completion.

- Complete the optional Broker's No. section if applicable.

- In the 'Information To Be Verified' section, specify the type of loan, the name on the loan, loan number, and current balance.

- Provide the name and address of the applicant(s) at the end of Part I and collect their signatures.

- Transition to Part II - Verification of Loan. The creditor will fill out information about loans outstanding to the applicant(s), including type of loan, loan number, date of loan, and original loan amount.

- Ensure that the creditor enters the current balance, date last paid, and date next due for each loan listed.

- Encourage creditors to include any additional information that may assist in determining creditworthiness, such as the number of late payments.

- Finally, the creditor representative must sign in Part III, indicating their title, printed name, and phone number, along with the date.

- Once all sections are accurately filled, review the form for completeness, then save changes, download, print, or share the form as needed.

Start completing your Request For Verification Of Loan online today.

To verify loans, you should begin by obtaining documentation from the borrower, such as loan agreements and payment records. Then, use a Request For Verification Of Loan form to confirm the loan details with the lender. This process helps you ensure the authenticity of the loan and understand the borrower's repayment history. Additionally, US Legal Forms offers convenient templates to help you create a professional verification request efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.