Loading

Get Sctc 111

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sctc 111 online

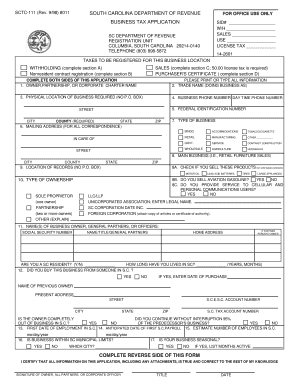

The Sctc 111 form is an essential document for registering your business for various taxes in South Carolina. This guide will walk you through the process of completing the form online, ensuring you provide all necessary information accurately.

Follow the steps to successfully complete your Sctc 111 application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete section A for withholding registration if applicable by checking the appropriate boxes and providing necessary details.

- Fill out section B if you are a nonresident contractor; ensure you check the exemption if applicable.

- In section C, provide details to apply for a retail sales license, including selecting whether you are an in-state or out-of-state seller and entering the anticipated date of first sales.

- Complete section D to apply for a purchaser's certificate of registration for use tax, ensuring you enter the effective date of registration.

- Review section E to indicate if your mailing address for returns differs from the main application and fill in the appropriate information if necessary.

- Fill in your business information in the designated sections, such as owner names, business address, and type of business.

- Certify the information by signing the form and dating it, ensuring all required parties sign.

- Upon completion, save your changes, then download, print, or share the form as needed.

Begin your online application process for the Sctc 111 form today!

You can file form 10IE after submitting your tax return, but you must do so before the deadline set by your tax authority. This situation often arises when new deductions or income sources come to light after your initial filing. Ensure that you adjust your records accordingly to reflect this. If you're in need of assistance, USLegalForms can help you navigate these adjustments in light of Sctc 111.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.