Loading

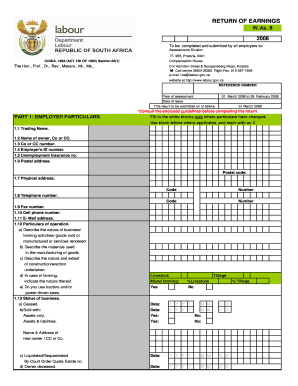

Get Return Of Earnings 2007 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Return Of Earnings 2007 Form online

This guide aims to support users in completing the Return Of Earnings 2007 Form efficiently and accurately online. By following these steps, you can ensure your submission is correct and timely.

Follow the steps to fill out the form correctly.

- Press the 'Get Form' button to access the form and open it in your preferred editor.

- Begin by filling in the employer particulars in Part 1. Ensure that you only complete the white blocks where there have been changes. It is essential to use block letters where appropriate, and mark with an X where necessary. Include your trading name, the name of the owner or company, employer ID number, and contact details.

- In Part 1, section 1.12, provide the particulars of your operation. Describe the nature of your business or services, along with materials used and any relevant construction details.

- Proceed to Part 2, where you will report the earnings of all permanent, temporary, and casual employees for the specified period. Start by indicating the average number of employees during the assessment year.

- In Part 3, estimate the average number of employees expected for the upcoming period and state the expected earnings. Use the established formats to detail the anticipated payment amounts.

- Finally, sign and date the document as required. Verify that all information is accurate, as this document must be certified for submission.

- You can now save any changes made, download the completed form, print it for your records, or share it with the relevant authorities.

Complete your Return Of Earnings form online today to ensure compliance and accurate reporting.

To submit a Return of Earnings (RoE) online in South Africa, visit the designated online portal and follow the submission guidelines. Ensure all data inputted correlates with the figures outlined in your Return Of Earnings 2007 Form. Taking advantage of helpful resources, like US Legal Forms, can make this submission seamless and efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.