Get Sba Form 160a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba Form 160a online

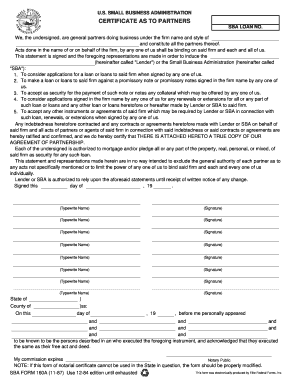

The Sba Form 160a is an important document for partners seeking loans through the Small Business Administration. This guide provides clear, step-by-step instructions to help users fill out the form online, ensuring that all necessary information is accurately provided.

Follow the steps to complete your Sba Form 160a online.

- Click 'Get Form' button to access the form and open it in your online editor.

- Begin by entering the SBA loan number at the top of the form, ensuring it is accurate, as this identifies your specific loan application.

- In the section labeled 'Firm Name', type the official name under which all partners are conducting business.

- List all general partners by typing out their names in the designated fields. Each partner should ensure their information is correct and clearly represented.

- Review the statements regarding the authority of each partner. Make sure all partners understand and agree with the binding statements listed.

- Include the date of signing and ensure that each partner provides their signature at the end of the document. Utilize the typewrite name fields for clarity if needed.

- Fill in the notary section by including the date, state, and county, along with all necessary notary information. This section confirms the authenticity of partner signatures.

- Review all entered information for accuracy. Any mistakes could delay the loan process. Once confirmed, proceed to save your changes.

- You can then download, print, or share the completed form as required.

Take action now by completing your Sba Form 160a online efficiently!

The 20% rule for SBA financing indicates that small business owners should have at least 20% equity in their business when applying for certain loans. This requirement helps lenders assess the commitment of business owners to their ventures. When completing the SBA Form 160a, ensure that your financial information reflects compliance with this rule to avoid delays in the approval process. Clarity and accurate reporting are essential to successfully navigate SBA financing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.