Loading

Get Formulario 351

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulario 351 online

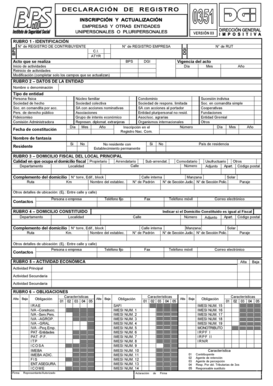

The Formulario 351 is an essential document for individuals and entities to register with the tax authorities. This guide provides a step-by-step approach to help users complete the form accurately and efficiently online.

Follow the steps to fill out the Formulario 351 online:

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin with 'Rubro 1 - Identificación', where you will need to indicate the type of act being performed, such as the start, restart, or modification of activities. Ensure to provide the relevant dates in the specified format.

- Proceed to 'Rubro 2 - Datos de la Entidad'. Fill in the entity's name and indicate the type of entity. Provide the registration number from the National Commercial Register and the date of establishment as required.

- In 'Rubro 3 - Domicilio Fiscal del Local Principal', specify the details of the main tax address, including the department, street, locality, and any additional identification numbers.

- For 'Rubro 4 - Domicilio Constituido', enter details about the constituted address. Check if it is the same as the main tax address and provide necessary contact information.

- In 'Rubro 5 - Actividad Económica', indicate the economic activities by marking principal and secondary activities relevant to your entity.

- Move to 'Rubro 6 - Obligaciones' and list any obligations the entity has, indicating whether they are newly formed or dissolved.

- Complete 'Rubro 7 - Otros Datos' section by marking conditions applicable to your entity, such as import/export status and any special circumstances.

- In 'Rubro 8 - Régimen de Aportación al B.P.S.', indicate the type of contribution applicable to your entity.

- Provide the necessary details in 'Rubro 9 - Datos del Titular'. Make sure to fill in personal details, including contact numbers, email addresses, and residential address.

- Review all the provided information for accuracy. Once all fields are complete, you can opt to save your changes, download the completed form, print it, or share it as needed.

Complete your Formulario 351 online today to ensure compliance with tax regulations.

To call AIMA in Portugal, you need to find their official contact number on their website. Make sure to check their operating hours to ensure you connect with them at the right time. For detailed assistance and contact strategies, US Legal Forms can offer useful guidance to help you reach out effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.