Get Hsa Application And Salary Reduction Agreement - Arbenefits - Nlrsd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HSA Application And Salary Reduction Agreement - ARBenefits - Nlrsd online

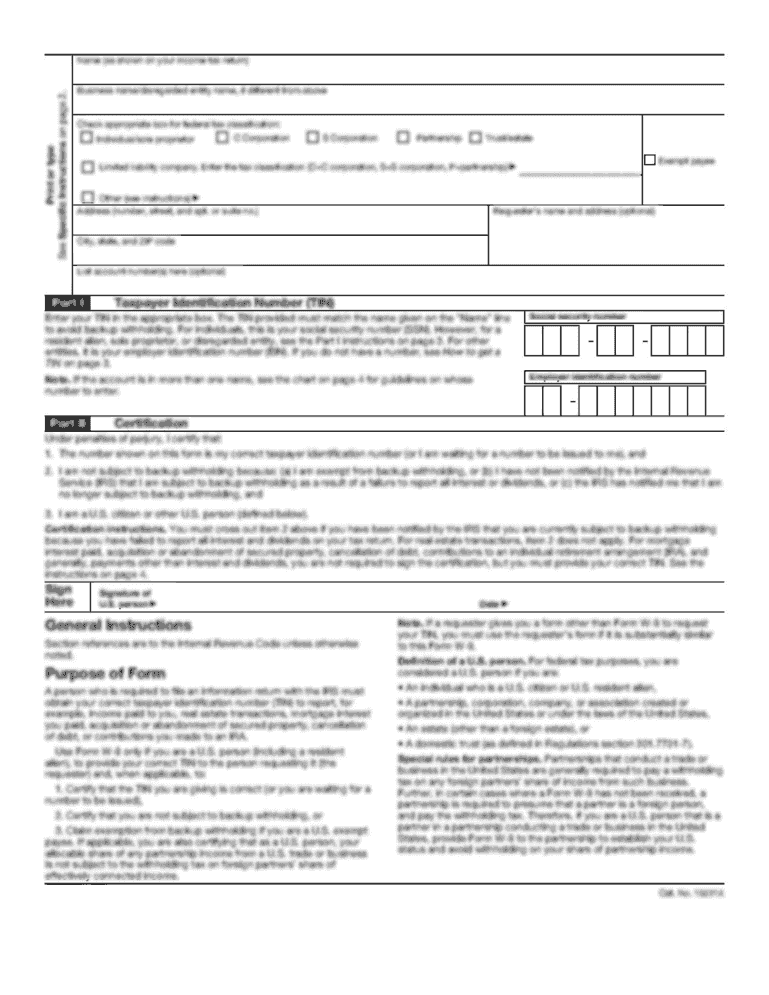

The HSA Application And Salary Reduction Agreement allows users to manage their Health Savings Account contributions efficiently. This guide provides detailed instructions to help users complete the form accurately and effectively in an online environment.

Follow the steps to successfully complete the form online:

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

- Determine your eligibility by specifying whether you are a current HSA Account Holder. If yes, fill in only your name in Section 1 and proceed to Sections 2 through 5. If no, complete all fields on both sides of the form and ensure to sign it.

- In Section 1, Input your account holder information. This includes your first name, middle initial, last name, preferred mailing address, home address, city, state, zip code, preferred phone number, email address, date of birth, social security number, driver's license number, and mother’s maiden name for security.

- Move to Section 2 to elect a monthly contribution amount to your HSA. Enter the specific dollar amount you wish to contribute and the date this election will take effect.

- In Section 3, provide your High Deductible Health Plan (HDHP) information, including the coverage date and whether you have single or family coverage.

- If desired, request a debit card in Section 4 by marking the checkbox and entering the name exactly as it should appear on the card.

- Finally, review and complete Section 5 by certifying that you are an eligible individual, signing the form, and dating it. Ensure your employer signs and dates as well.

- Once all sections are completed and signed, save changes, then proceed to download, print, or share the form as necessary.

Complete your documents online to manage your HSA contributions effortlessly.

The HSA salary reduction agreement is a binding document that allows you to designate a portion of your paycheck for your HSA before taxes are calculated. This agreement, as part of the HSA Application And Salary Reduction Agreement - ARBenefits - Nlrsd, plays a pivotal role in streamlining your contributions and ensuring tax efficiency. By signing this agreement, you make a proactive move towards enhancing your healthcare financial strategy. It's a smart decision to invest in your health.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.