Get Skip-a-payment Application - Greater Texas Federal Credit Union - Gtfcu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Skip-a-Payment Application - Greater TEXAS Federal Credit Union - Gtfcu online

This guide provides a clear, step-by-step approach for users who want to complete the Skip-a-Payment Application for Greater TEXAS Federal Credit Union online. Whether you are seeking financial flexibility or an emergency cash option, understanding how to fill out this application can facilitate the process.

Follow the steps to successfully complete the application.

- Click the ‘Get Form’ button to access the Skip-a-Payment Application form and open it in your preferred document editor.

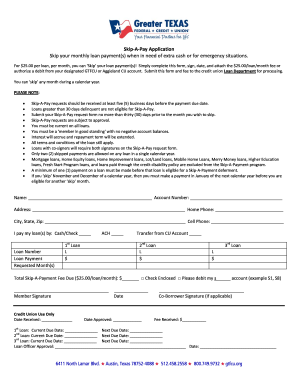

- Begin by filling in your personal information. Include your name, account number, and address. Ensure that all details are accurate to facilitate processing.

- Provide your home and cell phone numbers in the designated fields. Accurate contact information is essential for the credit union to reach you.

- Indicate how you typically pay your loans by selecting one of the payment methods: Cash/Check, ACH, or Transfer from CU Account. This information assists in processing your request.

- List your loans by providing the loan number, loan payment amount, and the requested month(s) for the payment skip for each loan. Make sure to include the correct details.

- Calculate the total Skip-a-Payment fee based on the number of loans and the $25.00 fee per loan, per month. Fill in the total fee in the provided space.

- Sign the document in the designated area, and indicate the date of your signature. If applicable, have your co-borrower sign as well.

- Submit the completed application along with the payment method you selected (either a check or the authorization for debit) to the credit union Loan Department.

- Ensure you keep a copy of the submitted form for your records. You may also want to follow up with the credit union to confirm receipt and approval of your request.

Start the application process today to manage your payments conveniently online!

To request to skip a payment, simply fill out the Skip-a-Payment Application - Greater TEXAS Federal Credit Union - Gtfcu available on our website. Once you complete the application, submit it for review. Our team will quickly process your request and notify you of the decision. This process is designed to provide you with peace of mind during those financial crunch times.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.