Loading

Get Ssa-44 2019

This website is not affiliated with any governmental entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSA-44 online

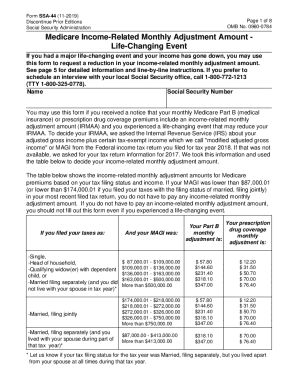

The SSA-44 form is utilized to request a reduction in your income-related monthly adjustment amount for Medicare due to a life-changing event. Completing this form online can simplify the process, ensuring your information is accurately submitted for consideration.

Follow the steps to fill out the SSA-44 effectively.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Begin by entering your identifying information, including your name and Social Security number exactly as they appear on your Social Security card.

- Select one life-changing event from the list provided, and enter the date that this event occurred using the format (mm/dd/yyyy).

- Next, indicate the tax year when your income was affected and provide the amount of your adjusted gross income and tax-exempt interest income as reported on your IRS Form 1040.

- Choose your tax filing status for the applicable tax year, selecting from the options provided.

- If you believe your modified adjusted gross income will reduce next year, complete the fields for the expected tax year, estimated adjusted gross income, estimated tax-exempt interest, and expected tax filing status.

- Provide evidence of your life-changing event and modified adjusted gross income, either by attaching documents or indicating that you will show them to an SSA employee.

- Read the important information above the signature line carefully before signing the form, and fill in your current phone number and mailing address.

- After reviewing all entries for accuracy, you may save your changes, download, print, or share the form as needed.

Begin the process of completing your SSA-44 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Social Security and Supplemental Security Income (SSI) benefits for nearly 69 million Americans will increase 1.6 percent in 2020. Read more about the Social Security Cost-of-Living adjustment for 2020. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $137,700.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.