Loading

Get Form 4 7

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4.7 online

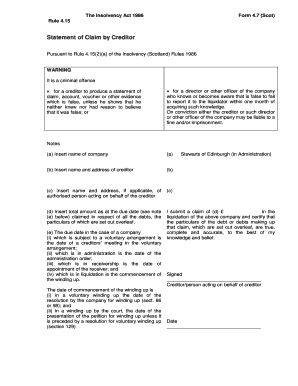

Filling out the Form 4.7 is an important step for creditors seeking to make a claim in insolvency proceedings. This guide will provide clear, step-by-step instructions to help users complete the form accurately and thoroughly.

Follow the steps to complete the Form 4.7 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by inserting the name of the company you are making a claim against in the designated field.

- Next, provide your name and address as the creditor in the appropriate section.

- If applicable, enter the name and address of any authorized person acting on your behalf.

- In the section titled 'Claim Amount', insert the total amount claimed for all debts as of the due date. Ensure this is accurate as per the details provided on the following page.

- Review the warning section regarding the consequences of submitting false information. Acknowledge this by certifying the claim is true and complete.

- For each debt, include a brief description detailing its nature, the date it was incurred, and when the payment became due.

- Specify the total amount of each debt, breaking it down into principal, interest (if applicable), and VAT. Make sure to indicate if VAT is being claimed back from HM Customs and Excise.

- Document any preferences claimed in respect of the debt as outlined in the relevant schedule.

- If applicable, provide details of any security held against each debt, including the subjects covered and their value.

- Finally, review all provided information for accuracy before saving changes, downloading, printing, or sharing the completed form.

Complete your Form 4.7 online today to ensure your claim is submitted accurately.

The fastest way to form an LLC in California is to file your documents online and select expedited processing if available. Utilizing services like USLegalForms can further streamline this process, making it easier to complete Form 4 7 and other required documents. This approach not only saves time but also helps you navigate California’s legal requirements effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.