Loading

Get Ho60

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ho60 online

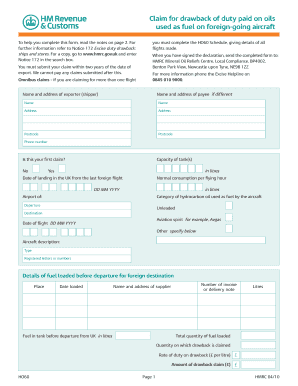

Filing the Ho60 form online is an essential step for individuals seeking a drawback of duty paid on oils used as fuel for foreign-going aircraft. This guide provides an easy-to-follow overview of how to effectively complete each section of the form to ensure accurate submission.

Follow the steps to successfully fill out the Ho60 form.

- Click the ‘Get Form’ button to access the online document and open it in the designated editor.

- Begin by entering the name and address of the exporter (shipper) in the appropriate fields. If the payee differs from the exporter, include their name and address as well.

- Fill in your contact phone number and indicate the capacity of the tank(s) in litres. Specify whether this is your first claim by selecting 'Yes' or 'No'.

- Input the normal consumption per flying hour in litres and the date of your last foreign flight’s landing in the UK by entering it in the format DD MM YYYY.

- Select the category of hydrocarbon oil used as fuel by the aircraft from the provided options, and fill out the airport of departure and destination.

- Record the date of the flight in the DD MM YYYY format.

- Provide a description of the aircraft, including type and registered letters or numbers.

- List the details of fuel loaded before departure for the foreign destination, including the place, date loaded, name and address of the supplier, invoice or delivery note number, total quantity of fuel loaded in litres, and fuel in the tank before departure from the UK.

- Indicate the quantity on which the drawback is claimed, the rate of duty on drawback in pounds per litre, and compute the total amount of drawback claim.

- Complete the declaration by signing and dating the form, indicating your capacity (e.g., sole proprietor, director).

- Once all fields are completed, review the form for accuracy and completeness before saving changes, downloading, printing, or sharing the document.

Submit your Ho60 form online today to ensure your claim is processed efficiently.

Related links form

To file DRC03A, start by acquiring the specific filing instructions related to your tax category. Using uslegalforms can provide you with the necessary templates and guidance for a smooth filing process. Ensure all information is accurate to prevent delays in processing your form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.