Get Ifta Standard Terms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ifta Standard Terms online

Completing the Ifta Standard Terms online requires careful attention to detail and a clear understanding of its components. This guide provides step-by-step instructions to help users navigate the form effectively and ensure all necessary information is accurately submitted.

Follow the steps to complete the Ifta Standard Terms form with ease.

- Click the ‘Get Form’ button to retrieve the Ifta Standard Terms document. This action will open the necessary form in an editor, allowing you to begin filling it out.

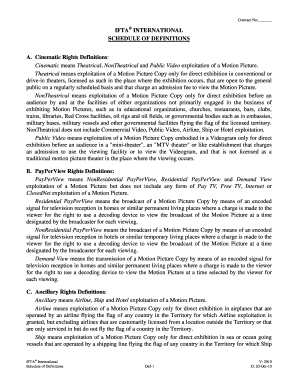

- Review the first section titled 'Cinematic Rights Definitions.' Pay close attention to the definitions provided, as they will inform how you categorize the motion picture rights you intend to describe within the form.

- Move on to the 'PayPerView Rights Definitions' section. Take time to understand each type of PayPerView right and determine how they apply to your situation.

- Next, complete the 'Ancillary Rights Definitions' area by detailing how you plan to exploit the motion picture through airlines, ships, or hotels. Ensure your entries comply with the definitions provided.

- Proceed to fill in the 'Video Rights Definitions' section. Carefully classify the type of video exploitation you will engage in, ensuring alignment with the definitions stated.

- Continue to the 'Pay TV Rights Definitions' and similar sections for Free TV and Internet Rights. Accurately reflect your intended usage based on the defined terms. This clarity will help avoid any potential legal issues later.

- Once you have filled out all relevant sections, take the time to review your entries for accuracy and completeness. This is critical to ensure that the document fulfills its intended purpose and aligns with legal standards.

- Finally, you can save changes, download a copy of the completed form, print it, or share it as needed. Make sure to store the document securely for future reference.

Take the next step and complete your Ifta Standard Terms document online today!

An IFTA audit can be triggered by discrepancies in your reporting, such as significant variances between your fuel consumption and mileage. Additionally, frequent errors or unusual patterns in your filings may raise red flags for tax authorities. Staying compliant with IFTA standard terms is essential to avoid audits, as accurate record-keeping and clear reporting help establish credibility and reduce the risk of scrutiny.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.