Get 2010 Ca Ftb Form 100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Ca Ftb Form 100 online

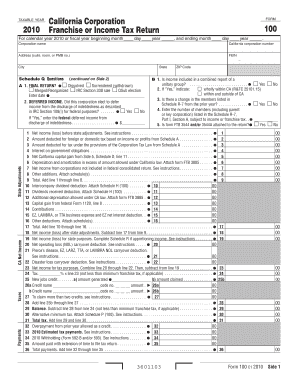

Filling out the 2010 Ca Ftb Form 100 online is a crucial step for California corporations to report their income and calculate taxes owed. This guide provides a clear and supportive approach to ensuring that users can effectively complete the form with ease.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to access the 2010 Ca Ftb Form 100. This will allow you to open the document in the appropriate online editor.

- Enter the taxable year at the top of the form. Ensure that the year is set to 2010. If you are filing for a fiscal year, indicate the beginning and ending months and days.

- Fill in the corporation name and California corporation number accurately. Provide the address, including suite or room numbers if applicable.

- Provide your Federal Employer Identification Number (FEIN) and zip code to ensure the correct processing of your tax return.

- Answer the questions in Schedule Q. Carefully indicate whether it is a final return, and if you elected to defer income from the discharge of indebtedness. Ensure to fill in any relevant dates.

- Proceed to the section concerning intercompany dividends and other additions or deductions. Follow each instruction regarding amounts and attach any necessary schedules.

- Continue through the form, completing fields for net income before state adjustments and other specific calculations as directed in the form.

- Review all calculations for tax due or overpayment. Ensure that all required line items and schedules are completed.

- Once the form is fully completed, you can save your progress, download, or print the form for your records. Make sure to share with relevant partners if needed.

Start filling out the 2010 Ca Ftb Form 100 online to ensure your corporation's tax filings are accurate and timely.

CA tax Form 100W is designed for corporations that elect to file as water's-edge filers. This form allows these corporations to only report income that is generated within California. If your situation necessitates using Form 100W, ensure you have the correct documentation ready and consider utilizing uslegalforms for comprehensive support and resources related to your tax filings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.