Loading

Get Blank Truth In Lending Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Blank Truth In Lending Form online

This guide provides clear and supportive instructions on how to fill out the Blank Truth In Lending Form online. By following these detailed steps, you can ensure that you efficiently complete the form with all necessary information.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

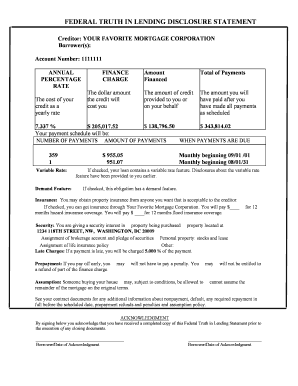

- Begin by entering your personal information in the 'Borrower(s)' section. This includes the names and any other relevant identifiers for all individuals who are applying for the loan.

- Fill in the 'Account Number' field with the specific account number assigned to your loan for easy tracking.

- Next, review the 'Annual Percentage Rate' section. This is important as it reflects the cost of your credit as a yearly rate. Confirm that the percentage is correct.

- In the 'Finance Charge', input the dollar amount that the credit will cost you over the term of the loan.

- For 'Amount Financed', enter the amount of credit provided to you, or on your behalf, after considering any prepaid finance charges.

- Fill out the 'Total of Payments' section, which indicates the total amount you will have paid after making all scheduled payments.

- Determine the payment schedule by filling out the 'Number of Payments' and 'Amount of Payments' sections, ensuring accuracy in your repayment strategy.

- If applicable, check the boxes for any variable rate and demand features related to your loan to provide full disclosure.

- Complete any sections related to insurance, including whether you will obtain property insurance through the creditor or another party.

- Before proceeding, ensure you read the late charges and prepayment policies carefully, making any necessary selections.

- Finally, acknowledge your understanding of the loan terms by signing and dating the acknowledgment section at the bottom of the form.

- Once you have filled out all required fields, review the information for accuracy, then save changes, download, print, or share the completed form as needed.

Start completing your documents online today for a more efficient process.

Truth in lending refers to the requirement that lenders disclose accurate and complete information about credit terms. This transparency allows consumers to make informed choices regarding their borrowing options. By utilizing a Blank Truth In Lending Form, you ensure you have a straightforward view of what you are agreeing to, which helps avoid surprises later on.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.