Loading

Get Form Rd 113

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Rd 113 online

Filling out the Form Rd 113 online can seem daunting, but with this guide, you'll navigate the process easily. This comprehensive instruction will help you understand each section of the form and ensure you complete it accurately.

Follow the steps to fill out Form Rd 113 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editing interface.

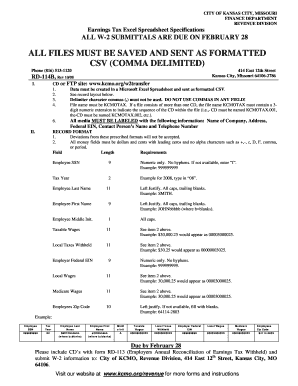

- Begin by providing your business details including the name of the company, address, and Federal Employer Identification Number (EIN). Ensure that this information is accurate and matches your official records.

- In the section for employee information, input the Employee Social Security Number (SSN) as a 9-digit numeric entry, omitting any hyphens. If the SSN is not available, input 'I'.

- Enter the Tax Year using a 2-digit format. For example, for the year 2008, you would input '08'.

- Fill in the Employee Last Name as an 11-character entry in all caps, ensuring that any trailing spaces are checked.

- Input the Employee First Name with a 9-character entry in all caps, similar to the last name. Again, confirm any trailing blanks.

- Provide the Employee Middle Initial as a single uppercase letter.

- Complete the Taxable Wages field, formatted correctly without characters or commas. For example, $30,000.25 should appear as '00003000025'.

- Fill in Local Taxes Withheld and format it like the Taxable Wages field, ensuring it fits within the specified character limit and format.

- Input the Employer Federal EIN in a numeric format, again without any hyphens.

- Repeat the previous formatting for Local Wages and Medicare Wages. Follow the same guidelines for inputting numeric values.

- Finally, fill in the Employees Zip Code in a 10-character format, justifying it to the left. If the zip code is unavailable, use blanks.

- Review all entries to check for accuracy. Then, save your changes, download, print, or share the form as necessary.

Start filling out your Form Rd 113 online today for a seamless submission process.

The earnings tax rate in Kansas City is currently set at 1% of gross earnings. This means that all taxable income earned within the city is subject to this rate. For complete compliance and to help you keep track, utilizing Form RD 113 will streamline the reporting process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.