Get In Respect Of Lost Or Misplaced Fixed Deposit Receipt Exceeding Twelve Month Period

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the In Respect Of Lost Or Misplaced Fixed Deposit Receipt Exceeding Twelve Month Period online

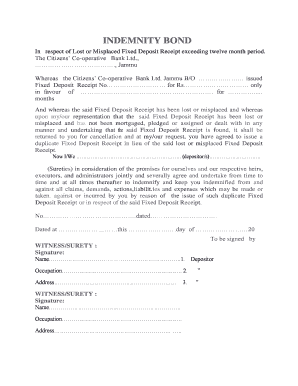

Filling out the In Respect Of Lost Or Misplaced Fixed Deposit Receipt Exceeding Twelve Month Period form online is a crucial step for users who need to replace a lost or misplaced fixed deposit receipt. This guide provides clear, step-by-step instructions to help users complete the form with ease and confidence.

Follow the steps to accurately complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by filling in the bank’s name at the top of the form: 'The Citizens’ Co-operative Bank Ltd., Jammu'.

- Enter the branch name where you initially obtained the fixed deposit receipt in the designated area.

- Provide the fixed deposit receipt number in the appropriate field.

- Input the amount of the fixed deposit in the space marked 'Rs... only'.

- Indicate the name of the beneficiary in the section that asks for the name in favour of the receipt.

- Specify the duration of the fixed deposit in months in the allotted space.

- Affirm that the receipt has been lost or misplaced and state that it has not been mortgaged or assigned. This declaration is often provided in a specific section of the form.

- Fill in your name(s) as depositor(s) in the space provided.

- Provide the necessary details of sureties, including their signatures, names, occupations, and addresses. This is usually found in the appropriate section for sureties.

- Complete the date fields, including the date of signing the document and the current location where it is signed.

- Once all fields are accurately filled, save your changes, download the completed form, and print or share it as required.

Start filling out your forms online today to ensure a smooth process.

A fixed deposit receipt is a document provided by banks upon investment in a fixed deposit account. It serves as proof of your deposit amount, maturity date, and interest rate. Understanding its implications is important, especially in respect of lost or misplaced fixed deposit receipts exceeding twelve month periods, as it facilitates the withdrawal and management of your funds.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.