Loading

Get Forms For Savings And Loans

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Forms For Savings And Loans online

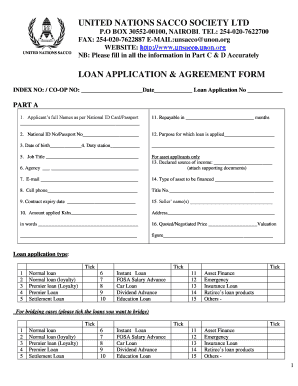

Filling out the Forms For Savings And Loans online can be a straightforward process when you have clear guidance. This guide will walk you through each section of the form, ensuring that you provide accurate and complete information for your loan application.

Follow the steps to successfully complete your loan application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out Part A of the form. Provide your full name as it appears on your National ID or Passport, along with your National ID or Passport number and date of birth.

- Enter your duty station, job title, and agency in the respective fields. Make sure these details are accurate.

- For asset applicants, declare your source of income and attach any supporting documents needed. Continue by providing your email address and cell phone number.

- Indicate the amount you are applying for in both number form and in words. Be clear about the purpose of the loan.

- Select the loan application type by ticking the appropriate boxes. Ensure you understand each loan type and choose one that best fits your needs.

- In Part B, gather and prepare the mandatory requirements, including copies of your payslip, ID, and any other documents specified.

- Proceed to Part C, filling out the loan agreement and declaration accurately. Specify the amount requested, repayment period, and install payment details.

- Sign the application and have a witness sign it as well. Ensure that all signatures are done in the designated areas.

- Complete Part E, detailing the security being offered for the loan and ensuring that all guarantors understand their responsibilities.

- Submit the form once it is completely filled out. Options may include saving changes, downloading, printing, or sharing the form.

Start completing your Forms For Savings And Loans online now to take the first step towards your financial goals.

Yes, you are required to report any interest earned from your savings account on your tax return. This includes interest income, even if you did not receive a 1099-INT form. Accurate reporting ensures compliance with IRS regulations, and using the right Forms For Savings And Loans can make this process easier. Always be proactive in managing your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.