Loading

Get R185 - (trust Income) - Statement Of Income From Trust. If You Are A Trustee, Use This Form To Tell

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R185 - (Trust Income) - Statement Of Income From Trust online

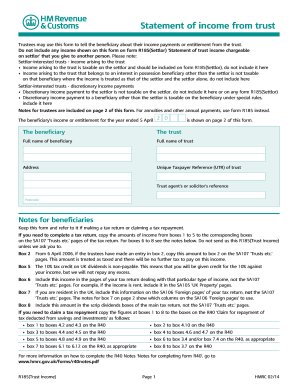

This guide provides clear and comprehensive instructions for filling out the R185 - (Trust Income) - Statement Of Income From Trust. Designed for trustees, this form is essential for reporting income payments or entitlements from the trust to beneficiaries.

Follow the steps to efficiently complete the R185 online.

- Click 'Get Form' button to access the R185 form and open it using your preferred application or web browser.

- Begin by filling out the section for the beneficiary's details, including the full name of the beneficiary and their address. Ensure to enter the unique taxpayer reference (UTR) of the trust where indicated.

- In the next section, include the name of the trust as well as the trust agent’s or solicitor’s reference if applicable. Verify that all information is accurate to avoid any processing issues.

- Proceed to the income reporting section. Here, report any net payments from non-settlor-interested UK resident trusts, ensuring to enter the actual amount paid.

- For payments from settlor-interested trusts, complete box 2 by entering the actual amount paid to a beneficiary other than the settlor. Do not include payments made to the settlor in this section.

- Continue by reporting any non-savings income, including rental income in the corresponding section. Make sure to specify amounts where tax credits or tax paid are to be indicated.

- Fill out the sections regarding foreign income where applicable, ensuring the appropriate amounts are reflected as per the trust's obligations and tax conditions.

- Complete boxes 7 and 8 about untaxed income and any stock/scrip dividends ensuring to provide relevant notes to the beneficiary about the types of income as necessary.

- Finally, sign and date the form in the designated area confirming that the information provided is accurate, then review the form for any errors before submission.

- Once completed, save the changes you made to the form. You may then download, print, or share the filled-out form for your records or submission.

Start filling out your R185 - (Trust Income) - Statement Of Income From Trust online today!

Determining trust accounting income involves analyzing the trust's financial statements and records. Use the R185 - (Trust Income) - Statement Of Income From Trust as a key resource to clarify income distributions. Accurate accounting practices and detailed record keeping are essential for a true reflection of income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.