Loading

Get 6000 4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 6000 4 online

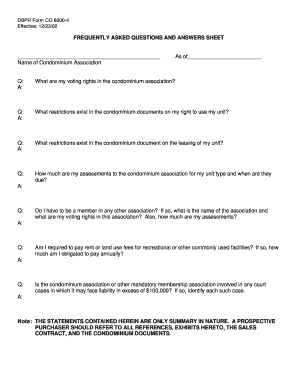

The 6000 4 form is a crucial document for individuals involved in condominium associations. This guide provides clear and structured steps to help you complete the form efficiently and accurately.

Follow the steps to fill out the 6000 4 form online.

- Click the ‘Get Form’ button to acquire the 6000 4 form and open it in your preferred digital editor.

- Begin by entering the name of the condominium association in the designated field.

- Fill in the effective date of the document, ensuring to provide the correct date.

- Address the questions listed in the form, providing clear and concise answers regarding voting rights, restrictions, assessments, and court cases, as applicable.

- Review all the entered information for accuracy and completeness.

- Once you have completed the form, you can save your changes, download it for your records, print it, or share it as needed.

Complete your 6000 4 form online today!

ITR-4 includes income generated from business activities, freelancing, and certain specified professions. Additionally, any income from short-term and long-term capital gains must also be reported within this form. Accurately tracking all sources ensures compliance and helps you understand your overall tax liability. For guidance on documentation and entry, resources such as US Legal Forms can be beneficial.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.