Loading

Get Form 12a Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 12a Pdf online

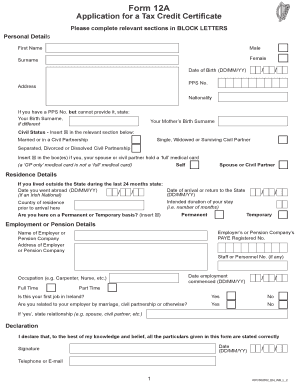

Filling out the Form 12a Pdf is a crucial step for individuals applying for a tax credit certificate in Ireland. This guide is designed to assist users of all experience levels in completing the form accurately and efficiently online.

Follow the steps to fill out the Form 12a Pdf online:

- Click the ‘Get Form’ button to access the Form 12a Pdf and open it in the form editor.

- In the personal details section, enter your first name and surname in BLOCK LETTERS. Select your gender by marking the appropriate box.

- Fill in your date of birth, personal public service number (PPS No.), and address. Indicate your nationality and provide your birth surname if it differs from your current surname.

- Specify your civil status by inserting 'T' in the relevant section and mark if you or your spouse/civil partner holds a full medical card.

- In the residence details section, provide information about your previous residency if applicable, including dates and country. Indicate if your stay is permanent or temporary.

- For employment or pension details, enter your employer's or pension company's PAYE registered number, their name and address, and your occupation. State if it is your first job in Ireland and whether you are related to your employer.

- Complete the income section by declaring all relevant sources of income, providing the type and amount received.

- Claim any tax credits, allowances, and reliefs by inserting 'T' in the necessary boxes. If claiming tax credits as a married person or civil partner, fill in the required details about your spouse or civil partner.

- Review the declaration statement, enter the date and provide your signature, phone number, or email.

- Once you have completed all sections, save your changes. You may then download, print, or share the completed Form 12a Pdf as needed.

Begin filling out your Form 12a Pdf online to ensure a smooth application process for your tax credit certificate.

To calculate line 12a on your 1040 form, you need to summarize your total income and deduct any relevant expenses or credits indicated in box 12. Ensure that all inputs from your Form 12a Pdf align with your financial records. Accurate calculations are key to achieving correct tax liabilities. If you're unsure, consulting uslegalforms can provide step-by-step assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.