Loading

Get Processing Loan Submission Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Processing Loan Submission Form online

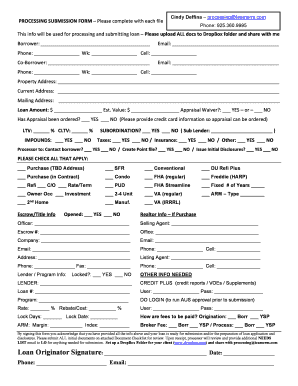

Completing the Processing Loan Submission Form is an essential step in facilitating the loan process. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently, ensuring a smooth submission experience.

Follow the steps to effectively complete the form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin with the 'Borrower' section. Enter the full name, email address, and phone numbers for both work and cell. Ensure all information is accurate.

- Next, fill out the 'Co-Borrower' section using the same guidelines as the borrower. This part is critical if there is a co-borrower involved in the loan process.

- Provide the 'Property Address,' 'Current Address,' and 'Mailing Address' where applicable. Ensure that all addresses are complete and correct to avoid processing delays.

- Indicate the 'Loan Amount' and 'Estimated Value' clearly. Additionally, answer the appraisal waiver question and whether an appraisal has been ordered.

- Fill in the loan-to-value (LTV) and combined loan-to-value (CLTV) percentages accurately. This will help assess the risk associated with the loan.

- Use the section to indicate whether any impounds, subordination, and necessary taxes or insurance considerations apply to this loan. Check 'Yes' or 'No' as relevant.

- Complete the 'Processor to' section by specifying tasks such as contacting the borrower and creating a Point file. Check the appropriate boxes.

- In the 'Please check all that apply' section, indicate the type of loan for which you are applying. Ensure that you check all relevant categories.

- If applicable, fill in the 'Escrow/Title Info' with the necessary details about the transaction, including the name and contact information of realtors involved.

- Lastly, provide any additional lender and program info needed, including lock details and payment options for fees. Ensure this section is completed to avoid further follow-ups.

- Before submitting, review all entered information for accuracy. Make any necessary edits, save changes, and download or share the form via an appropriate method.

Take the first step towards loan processing by completing your form online today!

Filling out the Processing Loan Submission Form is straightforward. Begin by providing your personal information, including your name, address, and contact details. Then, include financial details such as your income and credit information. Make sure to review your entries carefully before submitting the form to ensure accuracy and completeness.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.