Loading

Get St 387

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 387 online

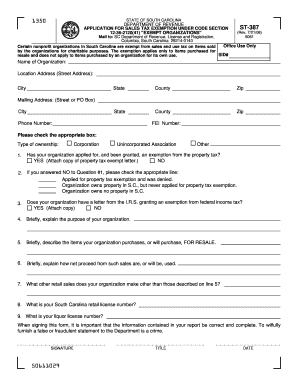

The St 387 form is essential for nonprofit organizations in South Carolina seeking a sales tax exemption. This guide provides clear and concise instructions on how to complete this form effectively online.

Follow the steps to accurately complete the St 387 form

- Click ‘Get Form’ button to access the St 387 document and open it in your preferred online editor.

- Enter the name of your organization in the designated field.

- Fill in the location address of your organization, including street address, city, state, county, and zip code.

- Provide your mailing address, city, and phone number in the appropriate sections.

- Input your Federal Employer Identification (FEI) number, which is necessary for identification purposes.

- Select the type of ownership by checking the corresponding box: Corporation, Unincorporated Association, or Other.

- Indicate whether your organization has applied for and received an exemption from property tax. Attach the required property tax exemption letter if applicable.

- If you answered 'NO' to the previous question, specify the appropriate line regarding your property tax status.

- Specify whether your organization has received a letter from the IRS granting a federal income tax exemption. Attach the IRS letter if applicable.

- Briefly explain the purpose of your organization in the provided space.

- Describe the items your organization purchases or intends to purchase for resale.

- Explain how the net proceeds from sales will be utilized by your organization.

- Provide details regarding other retail sales made by your organization that are not described in line 5.

- Enter your South Carolina retail license number.

- If applicable, enter your liquor license number.

- Review all information provided to ensure accuracy, as submitting false information is considered a crime.

- Sign the form, include your title, and date the application.

- Once completed, ensure you save your changes. You can download, print, or share the form as necessary.

Get started on filling out your St 387 form online today.

Filing an income tax calculation statement form entails compiling your income details, eligible deductions, and any applicable tax credits. Be sure that your submission is consistent with the St 387 specifications, as this ensures accuracy and compliance. It’s beneficial to verify your data before submission to avoid unnecessary errors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.