Get Form 46g

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 46g online

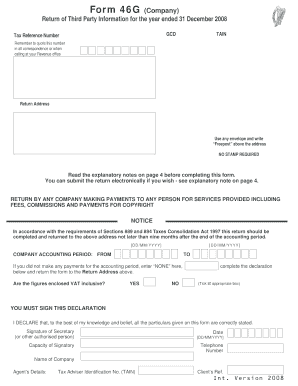

Filling out the Form 46g online is a straightforward process that ensures accurate reporting of third-party payments for services provided by companies. This guide will help you navigate each section of the form to complete it with confidence.

Follow the steps to accurately complete Form 46g online

- Click the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering your company details, including the tax reference number and return address. Ensure this is filled out clearly, as you must reference it in future communications.

- Specify the accounting period by entering the start and end dates. If no payments were made during this period, indicate by entering 'NONE'.

- Indicate whether the figures you will provide are VAT inclusive by selecting 'YES' or 'NO'. This is essential for accurate reporting.

- Complete the declaration at the end of the form by signing it and providing the capacity of the signatory. This confirms the accuracy of the information reported.

- Fill in the payee information, including their surname or full title, first name, private address, and business address if applicable. Ensure all information is complete and in block letters.

- Enter the total amount of payments made to the payee, ensuring that it exceeds €6,000 for it to be reported on this form.

- Mark whether VAT was charged in the transaction by ticking the appropriate box.

- Describe the nature of consideration received if it was not money, along with the nature of services or rights provided.

- Review all entries for accuracy. Once satisfied, save your changes, and download the form for your records. You can print or share the form as needed.

Complete your Form 46g online accurately to ensure compliance with reporting requirements.

A letter of clearance in Ireland is an official document issued by the Revenue Commissioners to confirm that an individual or company has settled their tax liabilities. This letter is often required for various financial transactions or when closing a business. Being aware of Form 46g may assist with understanding your tax standing and ensuring you’re in good standing when requesting this letter. Professional services can help navigate these requirements smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.