Get Caps Does Not Pay: Indemnification Letter - Caps Payroll

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CAPS Does Not Pay: Indemnification Letter - CAPS Payroll online

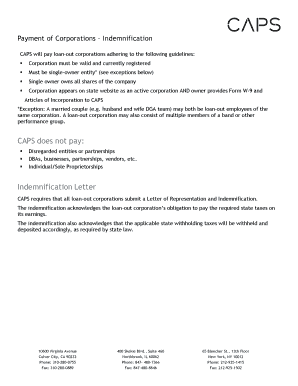

Completing the CAPS Does Not Pay: Indemnification Letter is essential for loan-out corporations to ensure proper payment processing through CAPS Payroll. This guide provides clear, step-by-step instructions to help you navigate the form easily, ensuring compliance and timeliness.

Follow the steps to complete the indemnification letter accurately.

- Click the ‘Get Form’ button to access the indemnification letter online. This action will allow you to open the document in an online editor, where you can begin filling it out.

- Enter the date at the top of the form. This date should reflect the day you are submitting the letter to CAPS.

- Fill in the 'Personnel’s Name' section with the full name of the individual who will be recognized as the service provider.

- Provide the 'Personnel’s Social Security Number' in the designated field to ensure accurate identification.

- Complete the 'Company Name' section with the legal name of the loan-out corporation that is being represented.

- Input the 'Company’s Taxpayer ID Number' to validate the business's tax identification for compliance.

- Fill out the 'Company’s Address' section. Ensure that this reflects the current and accurate business location.

- Provide a contact number for the company in the 'Company’s Telephone Number' field to facilitate communication.

- Review the representations and warranties provided in the form, ensuring that all information is accurate and reflective of the company's status.

- Both the lender's representative and the personnel involved need to sign the form in the designated signature areas to confirm agreement and understanding.

- Lastly, save your changes, and choose to download, print, or share the completed form as required by CAPS.

Be proactive and complete your indemnification letter online to ensure prompt payment processing.

Related links form

Yes, you can impose a cap on an indemnity to limit potential liabilities. This cap should be clearly defined in the agreement, specifying the maximum amount the indemnifying party may be liable for. Setting a cap helps maintain fairness and predictability in contractual relationships. For assistance in this process, refer to CAPS Does Not Pay: Indemnification Letter - CAPS Payroll.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.