Loading

Get Blank Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Blank Loan Application online

Filling out the Blank Loan Application online is a straightforward process. By following the instructions outlined in this guide, users can efficiently complete the application to secure financing for their housing needs.

Follow the steps to fill out your loan application effectively.

- Press the ‘Get Form’ button to access the loan application form and ensure it opens in your preferred online editor.

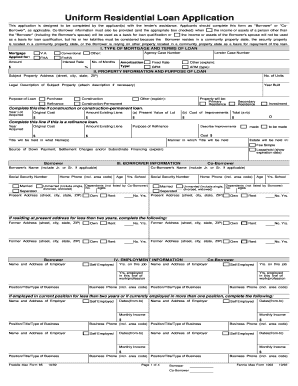

- Begin with section I, which covers the type of mortgage and terms of the loan. Select the loan type (e.g., VA, Conventional, FHA) and provide the loan amount, interest rate, and amortization type.

- In section II, fill out the property information and specify the purpose of the loan, such as purchasing or refinancing a property. Include the property address and details about its current use.

- Proceed to section III to enter borrower information. This includes names, social security numbers, marital status, and living arrangements for both the borrower and co-borrower, if applicable.

- Complete section IV by providing employment information for both the borrower and co-borrower. Include the name and address of the employer and the duration of employment in the current job as well as any prior positions held.

- In section V, outline your monthly income and combined housing expenses. This includes gross monthly income from all sources and details of current housing expenses such as mortgage payments, insurance, and taxes.

- Section VI requires you to detail assets and liabilities. List all debts, assets, and relevant financial information that reflects your financial situation.

- Next, fill in section VII regarding the details of the transaction, including purchase price and any other costs associated with the loan application.

- Section VIII consists of declarations which require you to answer compliance questions regarding financial history and obligations.

- Finally, review and sign the acknowledgment and agreements section in IX, ensuring all information is accurate. Include the date of submission.

- In section X, provide optional demographic information, and then verify via the provided check boxes if you wish to furnish it or not.

- Upon completion, save your changes, then download, print, or share the form as required.

Start completing your Blank Loan Application online today!

To obtain a loan without paperwork, look for lenders that offer no doc loans. Complete a Blank Loan Application, which requires limited documentation. Your credit score and income verification may be all that's necessary. This approach saves you time and hassle while still providing the funding you need.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.