Loading

Get Nj Form 306

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj Form 306 online

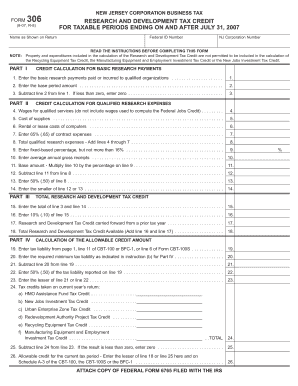

Filling out Nj Form 306 is essential for corporations seeking to claim the research and development tax credit in New Jersey. This guide provides easy-to-follow instructions for completing the form online, ensuring you meet all requirements.

Follow the steps to successfully complete the Nj Form 306 online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Enter the name as shown on your return in the designated field. This is important for verification purposes.

- Input your federal ID number accurately in the appropriate section, as this connects your form to your tax records.

- Fill in your New Jersey corporation number. Ensure this matches your official registration details.

- Begin Part I by entering the basic research payments made to qualified organizations on line 1.

- In line 2, enter the base period amount based on prior research payments.

- Calculate the difference by subtracting line 2 from line 1 on line 3. If the result is negative, enter zero.

- Proceed to Part II. Enter wages for qualified services in line 4, excluding wages related to the Federal Jobs Credit.

- On line 5, enter the cost of supplies related to your research activities.

- Fill in rental or lease costs of computers on line 6, ensuring relevance to your qualified research.

- On line 7, take 65% of contract expenses, ensuring you include any eligible amounts.

- Add lines 4 through 7 together on line 8 to determine total qualified research expenses.

- Enter the fixed-based percentage on line 9, ensuring it does not exceed 16%.

- Provide your average annual gross receipts on line 10.

- Multiply line 10 by the percentage from line 9, and document that amount on line 11.

- Subtract line 11 from line 8 on line 12.

- Calculate 50% of line 8 and enter that amount on line 13.

- Determine the smaller value between lines 12 and 13 and input that on line 14.

- In Part III, sum lines 3 and 14 on line 15 to find total credits.

- Calculate 10% of line 15 on line 16.

- Account for any Research and Development Tax Credit carried forward from previous years on line 17.

- Add line 16 and line 17 to find total credits available on line 18.

- In Part IV, enter your tax liability in line 19, followed by the required minimum tax on line 20.

- Subtract line 20 from line 19 and note the result on line 21.

- Calculate 50% of your tax liability from line 19, and enter that on line 22.

- Determine the lesser value between lines 21 and 22 and record that on line 23.

- Document any current year tax credits in line 24.

- Subtract line 24 from line 23 on line 25.

- On line 26, enter the lesser amount between line 18 or line 25.

- Complete Part V for credit carryover if applicable, by entering amounts from lines 27 and 28.

Complete your Nj Form 306 online today to take full advantage of available tax credits.

Related links form

Yes, you file an extension for state taxes using NJ Form 306. This form allows you to request additional time for your state tax return. Filing an extension helps you avoid late fees while ensuring you have sufficient time to prepare your taxes properly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.