Get Bop Inward Integrated Form - About Hsbc - About Hsbc Co

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BOP Inward Integrated Form - About HSBC - About Hsbc Co online

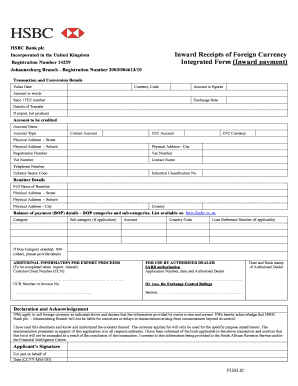

Filling out the BOP Inward Integrated Form is an essential step for users looking to manage their inward receipts of foreign currency through HSBC. This guide will walk you through each section of the form, providing clear, step-by-step instructions to ensure that your online submission is accurate and complete.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the BOP Inward Integrated Form. This will allow you to open the document in an editable format.

- Begin by entering the transaction and conversion details. Fill in the value date, currency code, and the amount in both figures and words. Ensure accuracy in the spot/forward exchange contract number and the exchange rate.

- Proceed to the details of the transfer section. If the transfer is related to exports, list any products involved. Specify the account to be credited by entering the account name and selecting the account type, either current account or CFC account.

- Provide the physical address for the account holder. Include details such as the street, suburb, city, registration number, tax number, VAT number, contact name, and telephone number.

- Next, complete the industry sector code and industrial classification number fields. These are essential for categorizing the transaction correctly.

- Fill in the remitter details by entering the full name, physical address (street, suburb, city, and country) of the remitter.

- In the balance of payment section, include the relevant BOP category and sub-category, the amount, and the country code. If applicable, provide the loan reference number.

- If the transaction relates to export proceeds, complete the additional information section, including the customs client number (CCN).

- Review the section 'For use by authorised dealer,' where applicable, and enter the SARB authorisation application number, date, and the authorised dealer details.

- Finalize your application by reading the declaration and acknowledgement statement carefully. Once confirmed, provide your signature, include the name of the person signing on behalf of the entity, and indicate the date in the format CCYY-MM-DD.

- After completing the form, save your changes. You can also choose to download, print, or share the form as needed.

Begin your online application process now by completing the BOP Inward Integrated Form.

An HSBC Intermediary bank is a third-party financial institution that facilitates international transactions on behalf of the bank. This setup is crucial when transferring funds across borders, ensuring secure and efficient processing. By using HSBC’s intermediary services, you can enhance your banking experience while managing your financial activities smoothly. For related forms or services, uslegalforms provides resources that can assist you in understanding intermediaries better.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.