Loading

Get Irs Form 8645

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 8645 online

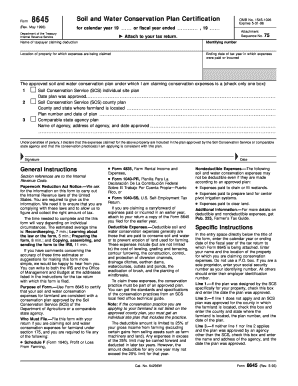

Filling out the Irs Form 8645 online can be a straightforward process if you understand its components and requirements. This guide will provide clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the online form.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Enter the calendar year or the ending date of the fiscal year for which you are submitting the form in the space provided directly below the title.

- Fill in your name and the location of the property for which you are claiming conservation expenses. Avoid using a P.O. box.

- In the 'Identifying number' section, if you are a sole proprietor, enter your social security number. If you have a different status, provide your employer identification number.

- Choose the appropriate box to indicate the type of conservation plan being used: either an SCS individual site plan, SCS county plan, or a comparable state agency plan. Fill in the required details such as the approval date, county and state information, and the agency details as necessary.

- Review your entries to ensure that all information is accurate and complete before finalizing the form.

- After you have verified your information, proceed to save your changes. You also have the option to download, print, or share the completed form as needed.

Ready to get started? Complete your Irs Form 8645 online now.

Mailing IRS Form 8453 is necessary if you choose to file certain tax returns electronically but need to include supporting documents. The IRS requires this form to verify your identity and the legitimacy of your submission. Using UsLegalForms can help you prepare and send this form correctly, making sure you follow all IRS guidelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.