Loading

Get Trust Receipt Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Trust Receipt Agreement online

Filling out the Trust Receipt Agreement online can seem daunting, but with clear guidance, it becomes a straightforward process. This guide will walk you through each section and field of the form to ensure you complete it accurately.

Follow the steps to effectively complete the Trust Receipt Agreement.

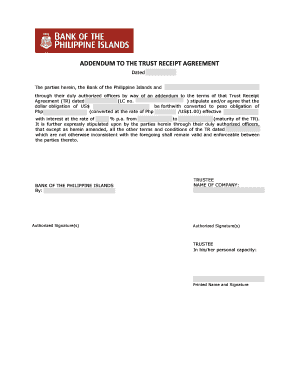

- Click the ‘Get Form’ button to access the Trust Receipt Agreement. This action will allow you to open the document in your online editor.

- Provide the date of the agreement, ensuring you enter it clearly in the designated field. This is crucial for the accurate tracking of your transaction.

- Identify the parties involved by filling in the name of the bank and your company. Make sure to include the authorized officers' names alongside their roles.

- In the section regarding the dollar obligation, input the amount in US dollars that needs to be converted. This will later form the basis for the peso obligation.

- Enter the equivalent peso amount in the following field, using the exchange rate provided. Ensure that you calculate this conversion accurately.

- Fill in the interest rate as stated in the agreement. Clearly denote this percentage to avoid any confusion regarding the terms.

- Specify the effective date of the conversion and the maturity date of the Trust Receipt Agreement in the required fields.

- Affix the necessary signatures in the designated areas, ensuring that signatures are from authorized representatives of both parties.

- Once all fields are completed, review the document for any errors or omissions. If everything is correct, you can finalize the form.

- Save your changes, then choose to download, print, or share the Trust Receipt Agreement online as needed.

Begin completing your documents online today with confidence and ease.

Writing a trust agreement involves a few essential steps. First, clearly define the purpose of the trust and identify the trustee and beneficiaries. Next, outline the specific assets you will place in the trust and the terms under which those assets will be managed. Consider using templates available through platforms like US Legal Forms to ensure your Trust Receipt Agreement meets all legal requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.