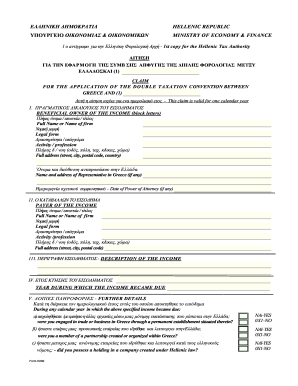

Get Claim For The Application Of The Double Taxation Convention Between Greece And Germany

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Claim For The Application Of The Double Taxation Convention Between Greece And Germany online

Filing a Claim For The Application Of The Double Taxation Convention Between Greece And Germany can seem daunting. This guide provides a comprehensive, step-by-step approach to successfully complete the form online, ensuring that you meet all requirements with ease.

Follow the steps to fill out the claim form accurately.

- Click ‘Get Form’ button to obtain the Claim For The Application Of The Double Taxation Convention Between Greece And Germany form and open it for completion.

- Begin by entering your full name or name of the firm in the section labeled 'Beneficial owner of the income'. Make sure to use block letters for clarity.

- Indicate your legal form by selecting the appropriate option from the choices provided. This may include options such as individual, corporation, or partnership.

- Provide details regarding your activity or profession in the dedicated field. This should be concise and relevant to the income being claimed.

- Fill in your full address, including street, city, postal code, and country. Accuracy here is vital to ensure proper communication.

- If applicable, enter the name and address of your representative in Greece. This is only necessary if you have appointed someone to act on your behalf.

- Complete the section for the payer of the income by entering their full name or firm name, legal form, and full address. This identifies the source of the income.

- In the 'Description of the Income' section, provide a clear and concise description of the income you are claiming under the double taxation convention.

- Specify the year during which the income became due in the field provided. This helps establish the timeframe for the claim.

- Answer the questions in 'Further Details' regarding your engagement in trade or business in Greece. For each question, select 'Yes' or 'No' as applicable.

- If you answered 'Yes' to any questions in Step 10, you must provide detailed information in the 'Observations' section regarding your involvement.

- In the 'Declaration of the Beneficiary' section, confirm your status as the beneficial owner of the income. Sign and date the declaration, ensuring all information is correct.

- If required, a certification from your tax authority regarding your residency status may need to be included. Follow the instructions provided in this section.

- Once all fields are filled out correctly, review the entire form. You can then save changes, download, print, or share the completed form as necessary.

Take the next step in your financial management by completing the claim form online today.

The DTAA, or Double Taxation Avoidance Agreement, with Germany is a legal framework that governs how taxes are applied on income arising in one country for taxpayers of another. This agreement helps clarify tax liabilities and prevent double taxation. For those interested in the Claim For The Application Of The Double Taxation Convention Between Greece And Germany, understanding the DTAA is critical.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.