Loading

Get State Of South Carolina Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of South Carolina Forms online

Filling out the State Of South Carolina Forms online is a straightforward process that empowers users to complete their documentation effectively. This guide provides clear instructions tailored to support individuals of all backgrounds in navigating the form with ease.

Follow the steps to complete the online form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

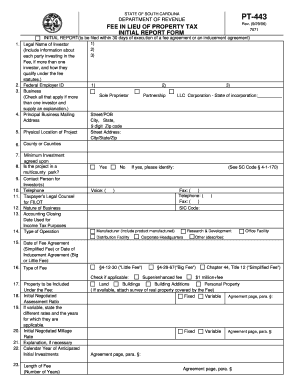

- Begin with Section 1, where you need to input the legal name of the investor. If there are multiple investors, ensure you include the names of each party and explain how they qualify under the relevant fee statutes.

- In Section 2, enter the Federal Employer ID for the investor.

- For Section 3, select the type of business entity by checking the appropriate box, such as Sole Proprietor, Partnership, LLC, or Corporation, and indicate the State of incorporation if relevant.

- Section 4 requires the principal business mailing address. Provide the street or P.O. Box, city, state, and the 9-digit zip code.

- In Section 5, input the physical location of the project, detailing the street address, city, state, and zip code.

- Section 6 is where you list the county or counties associated with the project.

- In Section 7, declare the minimum investment agreed upon.

- For Section 8, indicate whether the project is located in a multicounty park by selecting Yes or No.

- Section 9 asks for the contact person's name for the investor(s). Fill in their full name along with a phone number in Section 10.

- If applicable, provide the taxpayer's legal counsel information in Section 11.

- In Section 12, briefly describe the nature of the business.

- Enter the accounting closing date used for income tax purposes in Section 13.

- Select the type of operation in Section 14 by checking applicable categories.

- Section 15 requires you to state the date of the fee agreement or inducement agreement.

- Section 16 involves checking the type of fee applicable to your situation, such as 'Little Fee' if applicable.

- For Section 17, include details about the property that will be included under the fee.

- In Section 18, note the initial negotiated assessment ratio.

- If the initial assessment ratio is variable, detail the different rates and applicable years in Section 19.

- Section 20 requires you to note the initial negotiated millage rate.

- Provide any necessary explanations in Section 21.

- In Section 22, outline the calendar year of anticipated initial investments.

- Indicate the length of the fee in years in Section 23.

- In Section 24, detail the payment structure and any applicable agreement provisions.

- If there are any additional information, allowances, or restrictions, summarize them in Section 28.

- Finally, ensure you have signed the declaration at the bottom of the form, stating the information is true, correct, and complete. Fill in your name, title, signature, date, telephone number, and email address.

- After completing the form, you can save changes, download, print, or share the completed form as necessary.

Start completing your State Of South Carolina Forms online today!

Yes, South Carolina offers eFile forms to streamline the filing process. These electronic forms simplify the submission of legal documents, making it easier for you to meet your legal obligations. Using the State Of South Carolina Forms available through online platforms, you can reduce the chances of errors and save time. It's a convenient option for anyone looking to file documents in South Carolina.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.