Get Home Loan Application Form - Nab

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Home Loan Application Form - NAB online

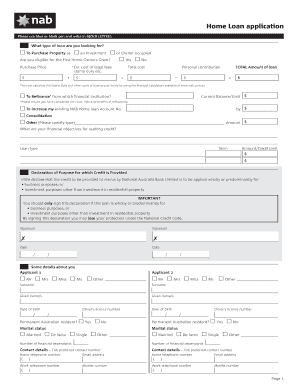

Completing the home loan application form with NAB is an important step towards securing financing for your property. This guide provides detailed instructions on how to fill out each section of the application form online, ensuring a smooth and efficient process.

Follow the steps to complete your application successfully.

- Press the ‘Get Form’ button to access the Home Loan Application Form - NAB online.

- Begin filling out the form by selecting the type of loan you are seeking, whether for an investment property or an owner-occupied home. Indicate your eligibility for the First Home Owners Grant by selecting 'Yes' or 'No' as applicable.

- Provide the purchase price and other estimated costs such as legal fees and stamp duty. Calculate the total cost and the total amount of loan required. Deduct any personal contributions to determine the net amount needed.

- Fill in your personal details as the applicant(s), including names, dates of birth, contact numbers, and marital status. Specify the number of financial dependents.

- Complete the employment section for each applicant by including employer information, job titles, employment status, and duration of employment. If self-employed, provide accountant details.

- Detail your financial position by listing your assets and liabilities. Include properties, bank accounts, loans, and other debts.

- In the monthly budget section, provide your income details, including salaries and any other sources of income, and list monthly expenditures.

- Review the declaration section where you confirm the purposes of the loan and provide your signature. Ensure all details are accurate before signing.

- After completing the form, you have the option to save your changes, download, print, or share the form, ensuring that you keep a copy for your records.

Start filling out your home loan application form online today for a seamless experience!

Yes, it is possible to buy a house in Australia with a $10,000 deposit, especially with properties priced around $200,000. However, this scenario might entail additional costs, such as Lenders Mortgage Insurance (LMI), to protect the lender. It’s essential to review your financial situation and consider the Home Loan Application Form - NAB to evaluate your options and potential eligibility for loans with lower deposits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.