Loading

Get Gst Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GST Certificate online

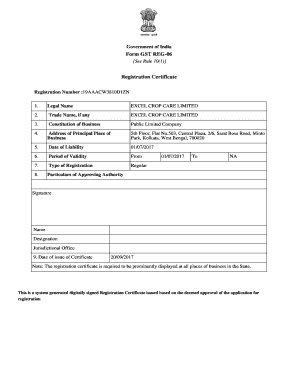

The GST Certificate serves as an essential document for businesses registered under the Goods and Services Tax system in India. This guide offers clear, step-by-step instructions to help users complete the GST Certificate accurately and efficiently.

Follow the steps to fill out the GST Certificate online.

- Click ‘Get Form’ button to obtain the GST Certificate form and open it in the document editor.

- Provide your legal name in the designated field. This should reflect the official name of your business as registered with the authorities.

- Enter the trade name, if applicable. If your business operates under a different name, include it here; otherwise, it can be the same as the legal name.

- Indicate the constitution of the business, such as 'Public Limited Company' or other applicable legal structures.

- Fill in the address of the principal place of business accurately, ensuring each component of the address is complete to avoid discrepancies.

- Specify the date of liability, which marks the beginning of your obligation to comply with GST regulations. This date is crucial for your registration.

- Outline the period of validity. Indicate the start date of the GST registration and leave the end date as 'NA' if there is no validity period.

- Select the type of registration, for example, 'Regular', to categorize your GST registration type.

- Fill in the particulars of the approving authority, including the date and details of the authority who approved your registration.

- Finally, provide the date of issue of the certificate. This date confirms when the certificate was officially issued.

- Once all fields are filled out, review the information for accuracy. You can then save changes, download, print, or share the GST Certificate as needed.

Complete your GST Certificate online today for an efficient business operation.

GST approval in India usually takes around 3 to 7 working days once you submit your application. In some cases, the approval could take longer if the tax authorities require additional information or verification. To enhance your chances of quick approval, double-check your application for completeness and accuracy. Trust platforms like US Legal Forms to assist you throughout this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.