Loading

Get Name Of Assessee

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Name of Assessee online

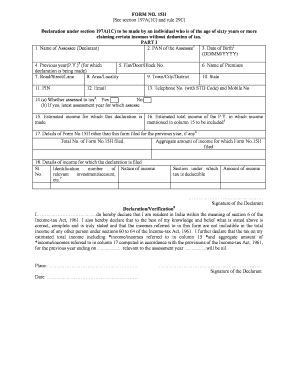

Filling out the Name of Assessee form is essential for individuals aged sixty years or older who wish to claim certain incomes without the deduction of tax. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the Name of Assessee form online.

- Click the ‘Get Form’ button to obtain the form and open it in your document editor.

- Fill in the Name of Assessee (Declarant) in the designated field. Ensure the name matches the one on your official identification documents.

- Enter your PAN (Permanent Account Number) in the respective section. This is a mandatory requirement for the validity of the declaration.

- Provide your Date of Birth in the format DD/MM/YYYY. This confirms your eligibility for the declaration based on age.

- Indicate the Previous Year for which you are making this declaration.

- Complete the Address section, including Flat/Door/Block Number, Road/Street/Lane, Area/Locality, Town/City/District, State, and PIN Code. Accurate address information is necessary for identification purposes.

- Fill in your Email address for correspondence. This will be used for any communication related to your declaration.

- Provide your Telephone Number (with STD Code) and Mobile Number. Ensure accuracy for effective communication.

- Indicate whether you have been assessed to tax by selecting 'Yes' or 'No'. If 'Yes', mention the latest assessment year for which you were assessed.

- Estimate and enter the income for which this declaration is made in the respective field. Accurate estimations are crucial.

- Provide the Estimated Total Income for the Previous Year, including the amount from the previous step.

- If you have filed any Form No. 15H previously for the same previous year, provide details regarding those filings.

- Detail the nature of income for which this declaration is filed, including identification numbers, aggregate amounts, and sections under which tax is deductible.

- Read through the declaration verification section carefully, and sign to confirm the accuracy of the information provided.

- Once all sections are completed, save your changes, and you may choose to download, print, or share the form for your records.

Start filling out the Name of Assessee form online to ensure your declaration is submitted promptly and correctly.

An assessee is anyone responsible for paying taxes under the Income Tax Act, including individuals, companies, and organizations. The term covers a wide range of taxpayers, from significant corporations to individual freelancers. Knowing who qualifies as an assessee helps in understanding tax obligations and rights within the legal framework.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.