Loading

Get Irs Form 2751

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 2751 online

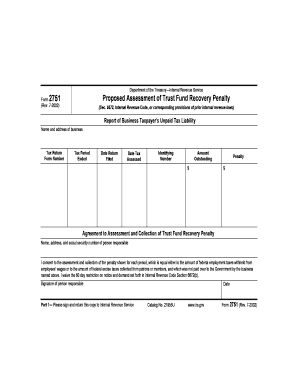

Filling out the Irs Form 2751 online is an essential process for business taxpayers experiencing an unpaid tax liability. This guide will provide you with clear and detailed instructions to complete the form efficiently and accurately.

Follow the steps to successfully fill out the Irs Form 2751 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the business in the designated fields. Ensure that all required information is accurate and up to date.

- Provide the tax return form number associated with the unpaid tax liability. This ensures that the form is tied to the correct tax obligations.

- Fill in the tax period ended date. This date marks the completion of the tax period for which the unpaid tax liability is being reported.

- Input the date the tax return was filed, which should reflect when the related taxes were originally submitted.

- Indicate the date the tax was assessed by the IRS. This is the date the IRS has set for financial obligations.

- Provide the identifying number associated with the business. This could be the Employer Identification Number (EIN) or a Social Security Number.

- Input the amount outstanding, representing the total tax liability due.

- Detail the penalty amount, which may be incurred due to the unpaid taxes.

- Complete the section regarding the agreement to the assessment and collection of the Trust Fund Recovery Penalty. Include the name, address, and Social Security number of the person responsible for the business's tax obligations.

- Sign the form, confirming your consent to the penalty and waiver of the 60-day restriction on notice and demand.

- Finally, save changes, download the completed form, print it, or share it as required for your records or submission.

Begin your process of filling out the Irs Form 2751 online today!

To file an IRS whistleblower claim, you need to submit IRS Form 211, which reports information about tax law violations. Make sure to provide as much detail as possible about the alleged fraud, including supporting documents. While IRS Form 2751 relates to tax liabilities, being informed about tax violations may also guide your approach and help protect your interests.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.